President Bola Tinubu has welcomed a new report from the National Bureau of Statistics which says Nigeria has recorded another trade surplus of $6.95 trillion in the second quarter of 2024.

The report said the current surplus is 6.60% higher than the $6.52 trillion surplus recorded in the first quarter.

In a statement by his Special Assistant on Information and Strategy, Bayo Onanuga, President Tinubu expressed confidence in the reforms his administration is pursuing, believing they will create a stronger economy that will usher in a new era of prosperity for Nigerians.

According to the presidential aide, the NBS report reflects the country’s strong export performance in the second quarter and comes days after the country reported an almost 100% oversubscription of its maiden domestic bond worth $500 million and half-yearly receipts of $1 trillion.

The NBS reported that the second quarter surplus was driven by exports to Europe, the United States, and Asia.

FG’s Dollar Bond Sale Raises $900 Million;

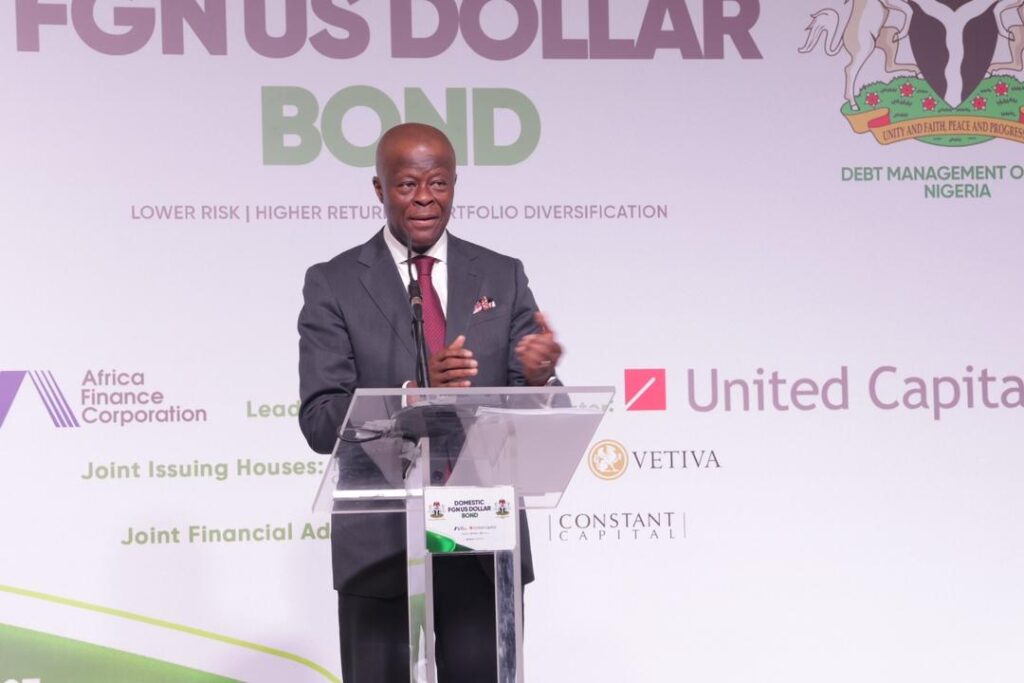

Wale Edun, Minister of Finance and Deputy Minister of Economy, on Wednesday, announced that $900 million of Nigeria’s first foreign currency-denominated domestic bond has been underwritten.

Discussing the results of Tuesday’s historic bond issue, Edun noted that the oversubscription reflects investor confidence in Nigeria’s economic stability and growth potential.

“The issuance of this inaugural domestic FGN US Dollar Bond highlights the continued faith investors have in Nigeria’s economy,” Edun said.

“I am particularly pleased that as Chair of the African Caucus, we have launched an initiative that not only strengthens Nigeria’s economic resilience but also expands the horizon for capital markets of African economies.”

The bond attracted a wide range of investors, including Nigerians and institutional investors both locally and internationally. If approved by President Bola Ahmed Tinubu, proceeds from the bond will benefit key sectors of the economy.

The $500 million, five-year, 9.75% FGN domestic dollar bond is the first tranche of a $2 billion bond program registered with the Securities and Exchange Commission. The bond’s structure allows the government to absorb oversubscriptions up to the program’s $2 billion limit.

Director-General of the Debt Management Office, Patience Oniha, said the success of the bond was a pivotal moment for Nigeria’s economic development. He noted that the $900 million raised from various investors highlights the growing complexity of Nigeria’s domestic bond market.