A Federal High Court in Lagos has scheduled October 21, 2024, as the hearing date for pending applications in a legal dispute between Barbican Capital Limited and First Bank of Nigeria Holdings Plc concerning alleged conflicts over shares valued at N5.4 billion.

The case, which has garnered significant attention, centers on Barbican Capital’s acquisition of a substantial stake in FBN Holdings and the challenges posed by other financial institutions, including Ecobank Nigeria.

The court presided over by Justice Ayokunle Faji, made the decision to adjourn the case during a session held on Wednesday, prompted by a request from Ecobank Nigeria Plc’s legal counsel, Kunle Ogunba (SAN), to join the ongoing proceedings as a party.

During the court session, the legal teams representing all parties in the dispute were present.

Barbican Capital Limited, the plaintiff, was represented by Bode Olanipekun (SAN), while Babajide Koku (SAN) appeared on behalf of FBN Holdings Plc, the first defendant in the case.

The Central Bank of Nigeria (CBN), which had been joined as a party to the suit at a previous hearing, was represented by Hakeem O. Afolabi (SAN).

Ecobank Nigeria, seeking to join the case, was represented by Kunle Ogunba (SAN).

At the hearing, Afolabi (SAN) informed the court that, in the prior session, the Central Bank of Nigeria had been formally joined as a party in the lawsuit.

He explained, “We have filed our processes in defence of the suit, although slightly out of time, and I have an application for an extension of time to regularise them.”

This statement implied that while the CBN had submitted its legal documentation later than required, an application was made to ensure compliance with court procedures.

The application was not opposed by any of the other parties involved in the case, and the court subsequently granted the request, allowing the CBN’s filings to be accepted as part of the ongoing proceedings.

Ecobank’s counsel, Ogunba (SAN), then notified the court of his client’s intention to join the case, submitting an application for this purpose.

However, before addressing Ecobank’s request to join the case, Justice Faji emphasized that the court wanted the current parties to first regularize their legal documents and filings.

Once the second defendant’s counsel completed this process and received the court’s approval, Ogunba proceeded to introduce Ecobank’s application for joinder, confirming that the process had been served to the plaintiff.

Ogunba elaborated on Ecobank’s position, stating, “My client also seeks leave to file a further affidavit in strict rebuttal to the plaintiff’s counter-affidavit,” indicating that Ecobank intended to provide additional legal arguments in response to Barbican Capital’s claims.

The court granted this request, permitting Ecobank to submit the necessary documents.

Following this, Ogunba made an unexpected declaration: “We intend to file an application for your lordship to recuse yourself from this matter.” This statement signaled Ecobank’s intention to request that Justice Faji step down from presiding over the case.

However, this request was met with a challenge from the plaintiff’s counsel, Bode Olanipekun (SAN), who argued that the issue of recusal had not been previously raised in the application for joinder, which had been served to the plaintiff on September 30, 2024.

Olanipekun contended that Ecobank’s decision to introduce the recusal request at this point in the proceedings was procedurally improper.

In response, Justice Faji addressed the matter, stating that the plaintiff’s legal team would need to formally respond to the recusal request before any further progress could be made in the case.

The judge remarked, “We will not move forward until the matter of recusal is settled.” This statement made it clear that the court would prioritize resolving the issue of whether Justice Faji would continue to preside over the case before proceeding with the substantive legal arguments.

As a result, the court granted Ecobank additional time to file its application for the judge’s recusal, with Justice Faji scheduling the next hearing for October 21, 2024.

This upcoming session will address the pending applications, including Ecobank’s request for the judge to step down.

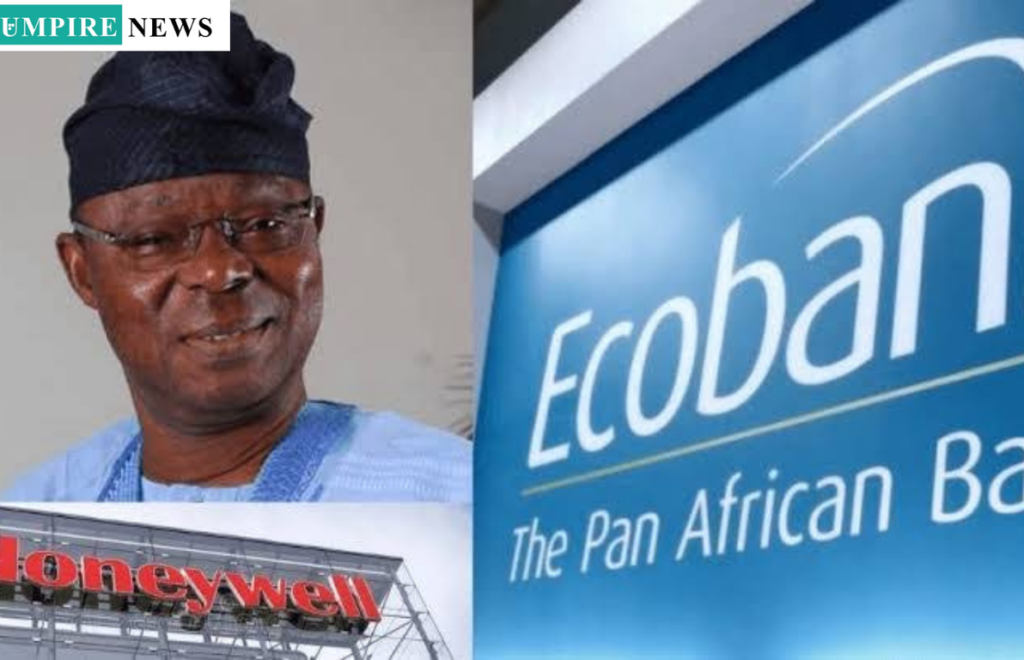

The case stems from a suit filed by Barbican Capital Limited, which is affiliated with Honeywell Group Limited. In the suit, filed under case number FHC/L/CS/1172/24, Barbican Capital claims to have cumulatively acquired 5,386,397,202 shares, representing 15.1% of FBN Holdings’ total shares listed on the Nigerian Stock Exchange (NSE).

However, Ecobank Nigeria has contested this action, arguing that the funds used by Barbican Capital to purchase the shares were allegedly misappropriated from the sale of Honeywell Flour Mills shares to Flour Mills of Nigeria Plc.

According to Ecobank, this financial maneuver was orchestrated by the Honeywell Group and its chairman, Dr. Oba Otudeko, in an effort to evade the repayment of debts owed to Ecobank.

The bank points to a previous ruling by the Supreme Court in its favor, asserting that the move to acquire shares in FBN Holdings was part of an attempt to divert assets and avoid honoring its financial obligations.

As the case continues to unfold, the October 21, 2024, hearing will be pivotal in determining the legal direction of the dispute, including whether Ecobank will succeed in its efforts to have the presiding judge recuse himself and whether Barbican Capital will maintain its significant stake in FBN Holdings.