Over the past five years, mobile money transactions in Nigeria have experienced exponential growth, increasing nearly 30-fold to a staggering N42 trillion.

This remarkable rise has been largely attributed to discounted offers and services from Chinese fintech companies, which have made significant strides in the Nigerian market.

Back in 2020, from January to July, mobile money transactions amounted to N1.37 trillion.

Fast forward to the same period in 2024, and this figure skyrocketed to N41.54 trillion, according to data provided by the Nigeria Inter-Bank Settlement System (NIBSS).

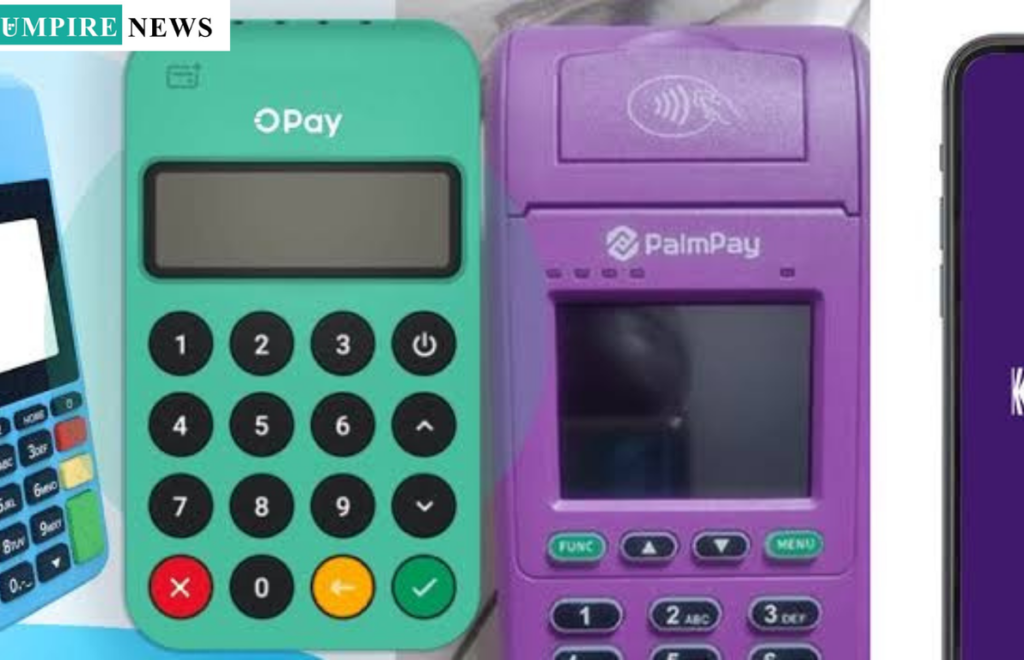

This leap in transaction volume is being led by two major Chinese fintech companies, Opay and Palmpay, both of which have played pivotal roles in reshaping Nigeria’s mobile money landscape.

Although there are 17 companies officially licensed by the Central Bank of Nigeria (CBN) to operate as mobile money providers (non-bank-led), the driving force behind this surge has been the Chinese fintech companies.

Opay and Palmpay have emerged as leaders in the mobile money space, taking advantage of Nigeria’s growing mobile adoption and a population eager for accessible financial services.

“OPay and PalmPay are the most prominent non-MNO-led mobile money providers and have gained significant market share in Nigeria since receiving their MMO license,” according to GSMA, a global telecom industry body.

Both companies capitalized on Nigeria’s rapid mobile expansion by offering free, fast transfers during their initial phase, and then shifting to heavily discounted services as they matured.

Their growth was further accelerated by Nigeria’s financial crises, particularly the failed Central Bank of Nigeria’s naira redesign and withdrawal limitation policy in 2022, which left traditional banking systems overwhelmed.

The Origins of OPay and PalmPay;

OPay’s journey began in 2010 under the name PayCom Nigeria Limited, initially operating as a mobile money platform under Telnet (Nigeria) Limited.

It wasn’t until 2018 that OPay underwent a major transformation when it was acquired by Opera, a company owned by Chinese billionaire Yahui Zhou.

With this acquisition came a rebranding and a renewed focus on expansion, setting the stage for its eventual rise as a leading fintech player in Nigeria.

PalmPay entered the Nigerian market a bit later, launching in 2019 after successfully raising $40 million in a seed funding round.

This funding was spearheaded by Transsion, a major Chinese mobile phone manufacturer.

A significant part of PalmPay’s early success was due to its integration with Transsion smartphone brands such as Tecno, Infinix, and Itel, ensuring that PalmPay came pre-installed on millions of devices.

Strategic Market Entry;

OPay’s entry into Nigeria’s market was strategic and multifaceted. Following Opera’s acquisition, OPay was developed into a super app, offering a range of services, including ride-hailing at competitive rates.

This broad suite of offerings quickly gained traction, with OPay’s active user base growing from 100,000 in April 2019 to an impressive five million by the following year. By June 2023, its user base had reached 30 million.

At the height of its operations, OPay offered 10 million rides each week across 18 Nigerian cities. Meanwhile, the company grew its agent network to more than 500,000 agents.

By mid-2020, OPay made the decision to pivot and focus solely on fintech, abandoning its other ventures.

PalmPay, on the other hand, leveraged its association with Transsion to rapidly grow its user base. By 2023, the company boasted 35 million users.

This expansion was largely facilitated by the overwhelming popularity of Transsion’s smartphones in Nigeria.

Canalys, a prominent global technology market analysis firm, revealed that in the third quarter of 2023, Transsion and Xiaomi were responsible for 85% of the smartphone shipments into Nigeria.

PalmPay’s Chief Executive Officer, Greg Reeves, highlighted the company’s strategic advantage early on: “On channel and access, we’re going to be pre-installed on all Tecno phones.

You’re going to find us in the Tecno stores and outlets. So we get an immediate channel and leg up in any market we operate in.”

By investing in a vast network of agents, PalmPay established a significant presence in both urban centers and rural areas. With around 500,000 agents, the company successfully created a broad base of users throughout Nigeria.

Victor Olojo, the former national president of the Association of Mobile Money and Banking Agents of Nigeria (AMMBAN), remarked on the aggressive market penetration strategy of these fintech companies:

“These fintechs were aggressive with their approach to penetrating the market. Most importantly is embracing the agent network model, where agents can recruit others for all of these operators with very good incentives in place, particularly for Moniepoint.”

The Power of Free and Low-Cost Transfers

Both OPay and PalmPay have adopted a strategy of offering free and low-cost transfers to attract and retain their growing user base.

For years, OPay provided free transfers, only introducing a minimal fee of N10 in June 2023 after the third daily transfer. PalmPay followed a similar approach, also offering free transfers for several years before implementing a small fee.

This customer-centric strategy was made possible by the significant financial backing each company had received. To date, OPay has raised $570 million in funding, while PalmPay has secured $400 million.

According to Victor Olojo, “Their success can be attributed to, first, their financial strength. Top players must have deep resources.”.

Navigating Nigeria’s Cashless Economy

The companies further solidified their positions during Nigeria’s naira redesign crisis in 2022. When the Central Bank of Nigeria announced the introduction of new naira notes and placed limits on cash withdrawals, traditional banks struggled to meet the surging demand for cashless transactions, resulting in frequent transaction failures. OPay and PalmPay seized this opportunity to provide alternative solutions.

By March 2023, OPay and PalmPay became Nigeria’s most downloaded finance apps, with OPay topping the charts as the most downloaded app in the country by October 2023.

OPay attributed its success to its robust IT infrastructure, which allowed for quick capacity expansion, far surpassing that of traditional banks.

“They made payment methods easier, faster, and better, and people began relying on them for everyday things,” said Adedeji Olowe, founder of Lendsqr.

Promoting Financial Inclusion

Both OPay and PalmPay have played key roles in promoting financial inclusion in Nigeria, enabling more citizens to participate in cashless transactions.

As noted by Nosa Oyegun, Vice President of Product and Innovation at Kuda, “There was a boom in microtransactions when the cashless issue happened.”

These fintech companies have onboarded millions of previously unbanked users by utilizing lower know-your-customer (KYC) requirements, making financial services accessible to a broader segment of the population.

“MMOs have succeeded in onboarding unbanked users using lower know-your-customer (KYC) requirements,” GSMA reported.

Looking ahead, PalmPay’s Managing Director, Chika Nwosu, emphasized the company’s commitment to reaching underserved populations:

“The future is all about financial inclusion. We want to reach out, especially to the last man, for the people who don’t even use a smartphone. Our major objective is to use technology to support financial inclusion.”

Nigeria’s contribution to the global rise in mobile money transactions has been significant, with the country leading the charge alongside Ghana and Senegal.

In 2023 alone, global mobile money transactions surged to $1.4 trillion, driven primarily by growth in these African nations, according to Mats Granryd, director-general of the GSMA.