The Chartered Institute of Bankers of Nigeria (CIBN) and the Body of Bank CEOs have expressed their concern over the increasing criticisms of Nigerian banks on social media platforms.

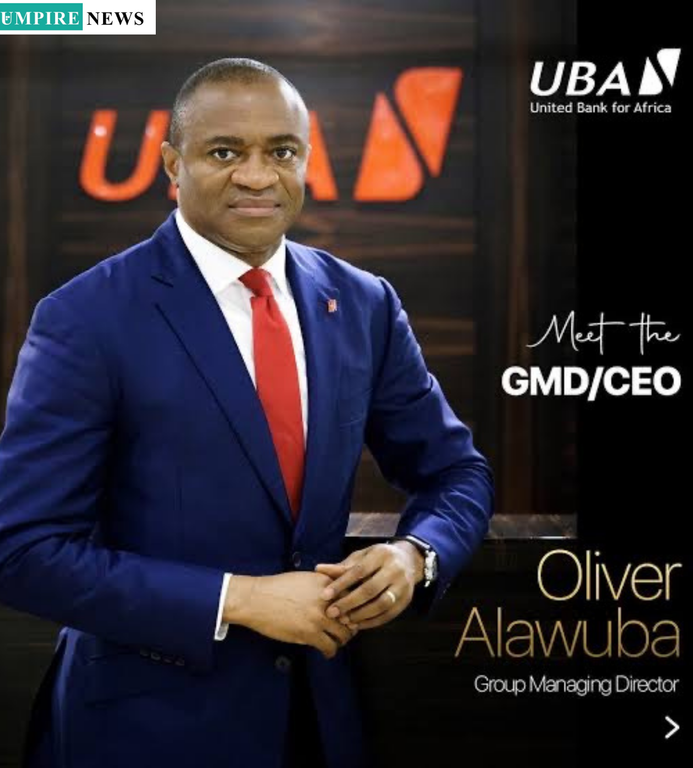

These financial bodies conveyed their dissatisfaction in a joint statement issued in Lagos on Tuesday, which was signed by Prof. Pius Olanrewaju, the President of CIBN, and Dr. Oliver Alawuba, the Chairman of the Body of Bank CEOs in Nigeria.

In their statement, both institutions emphasized the critical importance of the banking sector to Nigeria’s economy, noting that it remains one of the most regulated and essential components of the nation’s financial system.

They highlighted the sector’s contributions to economic growth and development, explaining that Nigerian banks continue to command the confidence of both retail and institutional investors.

The statement reaffirmed the solid foundation upon which the banking industry is built, underscoring its resilience and dynamic nature.

“The resilience and dynamism of the banking industry are built on the trust of its customers, demonstrating that the sector is a cornerstone of economic growth and development in Nigeria. Rather than being criticized, the continued strength of this sector should be a source of national pride,” it stated.

The statement further explained that the Nigerian banking sector plays a pivotal role in the nation’s economy, serving individuals, small businesses, large corporations, and the wider society.

It stressed that the economy relies heavily on the intermediary role of banks, a role that has had a profoundly positive impact across all sectors.

The contributions of banks to the financial health of the country, the statement noted, are undeniable and should be appreciated rather than maligned.

The statement encouraged the public to view the banking sector as a vital contributor to economic stability rather than subject it to unfair criticism.

The financial bodies advised that individuals or groups who have specific concerns or grievances about any bank’s operations should seek redress through the appropriate regulatory authorities.

These authorities, they noted, are equipped to investigate and resolve such concerns with impartiality and professionalism. The statement strongly discouraged the trend of resorting to social media attacks as a means of voicing dissatisfaction.

“Resorting to social media attacks, blackmail, or smear campaigns not only undermines the hard-earned reputation of these institutions but also seeks to unfairly manipulate targeted banks,” the statement pointed out.

This method of airing grievances, they argued, threatens to damage the reputation of the entire sector, which has worked diligently to build trust and credibility over many years.

The institutions appealed to those engaging in these actions to desist and urged them to consider the facts carefully before making any accusations that could harm the sector’s standing.

In addition, the statement emphasized that regulatory agencies are fully capable of handling any concerns in a professional and thorough manner.

These agencies, they stressed, are designed to maintain the integrity of the banking system, ensuring that banks adhere to the highest standards of service.

The banking industry, it added, remains committed to delivering top-quality services to all its customers, ensuring their satisfaction and trust in the system.

“Together, let us foster an environment of trust and collaboration, recognizing the positive impact of a professional sector that brings pride to Nigeria and Africa. As the banking sector continues its efforts to build a resilient Nigerian economy, we call on citizens to support its mission of creating a stronger economy that works for everyone,” the statement read.

It called for a collective effort to nurture trust and support for the banking sector, which it argued is critical to the financial health of the country.

The joint statement also highlighted the extensive regulatory framework that governs Nigeria’s banking industry.

According to the CIBN and the Body of Bank CEOs, Nigerian banks operate under rigorous regulations established by the Central Bank of Nigeria (CBN), their primary regulator, and other financial oversight bodies.

These regulations ensure that the banks maintain transparency, adhere to compliance standards, and uphold the trust of both local and international investors.

The statement further noted that many Nigerian banks are publicly listed, meaning they are subject to stringent oversight and reporting requirements.

These banks are not only accountable to local regulators but also adhere to international financial standards, which require them to maintain high levels of transparency and ethical practices.

As a result, Nigerian banks are continually audited by global experts, which has earned them consistently high ratings on both individual and collective levels.

In addition, the statement highlighted the caliber of professionals working within the Nigerian banking industry.

It noted that Nigerian banks are staffed by globally competitive and certified professionals who are held to high standards by both national and international regulatory bodies.

The professionalism and expertise of the staff, along with the sector’s compliance with regulatory standards, further enhance the credibility and strength of Nigeria’s banking system.

The CIBN and the Body of Bank CEOs emphasized the need for the public to appreciate the value that the banking sector brings to Nigeria’s economy.

They called for an end to the baseless criticisms that are being circulated on social media, urging individuals to rely on proper channels for any grievances.

By fostering a culture of trust and collaboration, the statement noted, Nigeria’s banking sector can continue to be a source of pride and a vital driver of the country’s economic success.