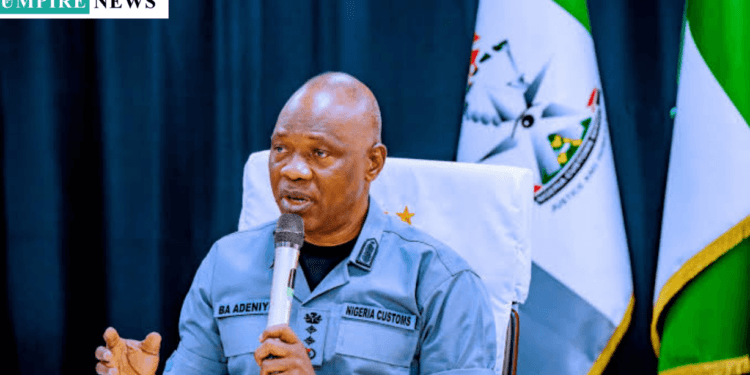

The Comptroller General of the Nigeria Customs Service (NCS), Adewale Adeniyi, says the proposed Nigeria Revenue Service Bill in the National Assembly threatens the existence of his agency.

He made his position known during the public hearing of the House of Representatives Committee on Finance on Wednesday.

The Customs boss, in his submission, raised some jurisdictional conflicting issues on the proposed Nigeria Revenue Service Bill.

He said, “The Nigeria Revenue Service Establishment Bill 2024, Section 1, provides a legal framework for the administration of taxes and revenue under any law where Section 42 defines tax. So, this particular section subsumes everything that is provided under Sections 3 and 4 of the NCS Act, 2023.

“We should encourage collaboration and integration of operations between Customs and the tax authorities, not abolish Customs or repeal a law because we want to make another law.”

He contends that because of the nature of its duties, the NCS should be permitted to operate independently rather than being included into the tax system.

He also noted that “Sections 23 and 29 of the bill, and section 41A of the Joint Revenue Bill have jurisdictional conflict issues.”

He differed that Section 16 of the Nigerian Revenue Service Establishment Bill will outright legislate the Nigeria Customs Service.

“In section 4S, there is also another omnibus provision. This particular provision gives the proposed NRS oversight functions over all taxes and levies.

“We are worried that this new law is seeking to override all previous laws that were done to address issues regarding the economy.”

He expressed worry about the use of the words “tax” and “duties” interchangeably in the proposed laws.

“The substitution of the word ‘tax’, the substitution of the word ‘duty’ by ‘tax’ in very many areas of the bill seems to overlook the difference and the objective which these two tools can do in an economy.

“Our understanding is that tax is used to generate revenue for governments, and it’s also used to distribute wealth. However, duty goes beyond that.

“Duty is more of a fiscal policy tool, an instrument by governments to encourage industrialisation, to discourage environmental pollution, and to put in some kind of public health order,” he explained.