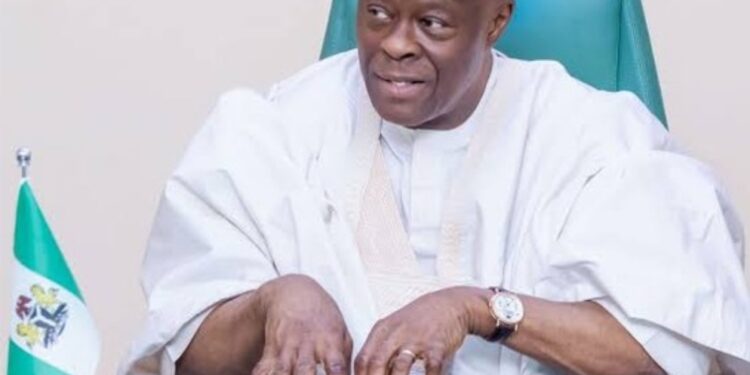

According to Finance Minister Wale Edun, the Federal Government would increase non-revenue in order to mitigate the negative consequences of trade tariffs that President Donald Trump has imposed on nations.

Recently, several nations globally were subject to tariffs ranging from 10% to 65% imposed by the Trump administration.

Additionally, Edun promised that the Economic Management Team (EMT) would convene to evaluate the probable effects of the 14% tax on Nigerian exports to the US.

According to him, the EMT will then offer suggestions to lessen its effects on the country’s economy.

Speaking at a Ministry of Finance Incorporated event on Monday, Edun stated that although a decline in oil prices would have a negative impact on Nigeria, the government is stepping up its efforts to increase oil output and increase non-oil income.

Nigeria received a 14 percent duty on its exports to the United States, one of several duties the Trump administration recently placed on nations worldwide, ranging from 10 percent to 65 percent.

In response to enquiries from reporters outside of the MOFI’s Corporate Governance Forum, Edun pointed out that the US, the focal point of the tariff war, had said on April 2 that it would exempt oil and other resource exports.

“Therefore, it’s the price effect, the oil price effect that may affect Nigeria. And it is the job and responsibility of the economic management team of President Bola Ahmed Tinubu, amongst others, to look at the various scenarios that might play out.

You may also like: US Trump Unveils Sweeping Tariffs on Imports

“There’s global uncertainty at a huge level, so nobody knows exactly what will happen- the announcement that has been made. We’re not sure what will be delayed, what will be reversed, or what will be implemented.

“So, it is not an announcement that the budget is being reviewed. It’s an announcement that it is our responsibility to look at the various scenarios and options and advise government accordingly.”

Earlier in his address at the event themed, “Ensuring Value Creation in State Owned Enterprises Through Better Corporate Governance,” Edun highlighted plans to look at budget adjustment, expenditure prioritisation as well as innovative non-debt financing strategies.

He said that during the previous three years (2022–2024), Nigeria had a trade surplus with the US.

“Nigeria-US Trade has been in surplus in the last 3 years (2022-2024). Nigeria’s exports to the US were N1.8 trillion, N2.6 trillion and N5.5 trillion in 2022-2024, respectively.

You may also like: The Trump Tariff Bombshell: All Countries to Be Affected

“Fortunately, oil and mineral exports accounted for 92 per cent. Implying oil and minerals exports amounted to N5.08 trillion in value while non-oil was just N0.44 trillion

“Consequently, the tariff effect on exports is negligible if we sustain our oil and minerals export volume.

“The adverse effect on Nigeria will be through oil price plunge. We are intensifying efforts to ramp up crude oil production to curtail any price effect

“We are also focusing on non-oil revenue mobilisation by FIRS and Customs, budget adjustment and prioritisation where possible, and also and innovative non-debt financing strategies,” the minister said.

Regarding MOFI’s emphasis on sound corporate governance, the minister stated that the discussion of corporate governance require an even greater relevance at a time when countries all over the world are struggling with financial vulnerabilities, economic uncertainty, and the need for structural transformation.

“The interplay between economic performance and corporate governance is neither incidental nor superficial. Instead, it constitutes the bedrock for establishing sustainable development, investors’ confidence, and institutional integrity.

“In this context, it is imperative that we not only discuss the state of our economy but also underscore the transformative role that sound corporate governance can play in fostering resilience, efficiency, and long-term value creation,” he said.

Since they have significant sway over important industries like energy, infrastructure, telecommunications, and financial services, he claims that State-Owned Enterprises (SOEs) are an essential part of the country’s economic system.

“However, their potential to drive economic expansion, job creation, and industrial growth has often been constrained by inefficiencies, poor financial stewardship, and, in some instances, governance deficiencies,” he said.