By: Vincent Amadi

Although the Nigerian Labour Congress (NLC) has agreed to suspend the indefinite nationwide strike for a week, economic analysts are concerned about its impact on the country’s financial markets, even as the outlook for the naira, as well as business in the stock market, remains pessimistic.

This comes after Africa’s second-largest economy lost about N141 billion in stock market investments due to rising tensions between the federal government and unions over the recent increase in electricity tariffs and the failure of a new minimum wage deal with the government.

According to data obtained from the Nigerian Exchange Limited (NGX) website, trading on the national stock exchange experienced a crackdown on the commencement of trading in the new trading week (in June) due to the general strike. The number of transactions, volume, and value of stock transactions decreased by 5.20%, 19.45%, and 38.92% respectively.

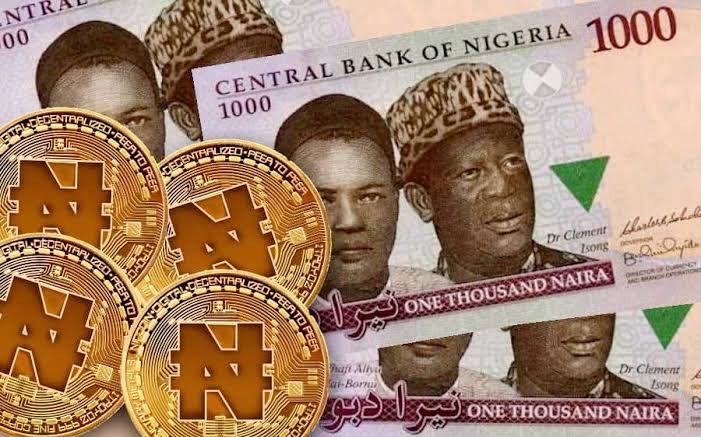

Furthermore, the naira is currently weakening against the British pound, near the N2000/£1 support line, as the British currency’s fortunes gain momentum in the global foreign exchange market.

Despite better market conditions in the domestic official market, sterling sold at N1,861 and N1,875 against the naira in the parallel market on Monday and Tuesday, respectively.

According to market analysts, this is partly due to industrial action by NLC leading to increased speculation, hoarding, and delays in foreign exchange payments to change bureau operators. According to analysts at Rand Merchant Bank (RMB), exchange rate fluctuations remain a major concern for investors.

“Liquidity in Nigeria’s foreign exchange market has declined due to exchange rate instability and relentless inflation rates that have scared away foreign investors,” Analysts at Cordros Research said. The outlook for the Naira remains bleak with expectations for the currency to continue to decline in the near term.

Despite the CBN’s strategic interventions and improved investment flows into its foreign portfolio, underlying demand pressures and market dynamics suggest that the naira will continue to face many challenges.

Domestic investors will likely focus on stocks, seeking stability and potential returns amid volatile currencies.