The Manufacturers Association of Nigeria (MAN) said the failure of the Central Bank of Nigeria to clear $2.4 billion worth of forward exchange transactions has caused serious problems for manufacturers, leading to price hikes and business halts.

In a statement, MAN general manager, Segun Ajayi Kadiri, said the ongoing delays have eroded investor confidence in banks to fulfil contracts with manufacturers to buy goods pegged to foreign currencies.

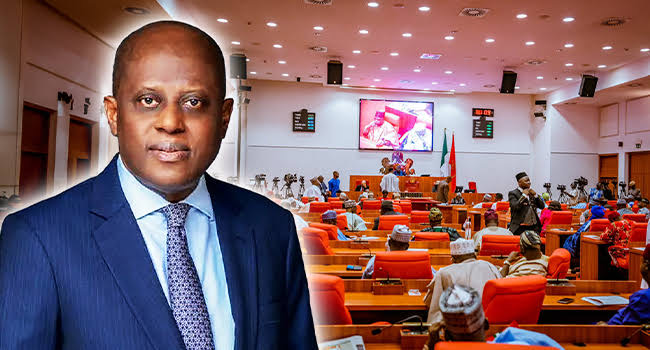

According to Journalists, since the Olayemi Cardoso-led management took over, the CBN has cleared over $4 billion of the $7 billion it acquired, but about $2.5 billion is yet to be cleared, raising concerns among manufacturers.

The MAN general manager, however, noted that while banks cited ongoing investigations by the EFCC as the reason for the delays, companies that borrowed funds from banks to obtain letters of credit have been hit hard by the rising exchange rate against the dollar. The naira is set to depreciate by 2023 and will suffer huge losses in 2024.

“This $2.4bn worth of forward contracts from the backlog of $7bn has triggered a severe crisis for the manufacturing sector and Nigerian economy. Worse still, the commercial banks have continued to charge dollar accounts along with other naira bank charges such as 35 percent interest rate on the facilities that these companies have with their banks. All these have significantly eroded the working capital of the companies who barely make margins of 5 percent on the sales of the products. This rather worrisome breach of contract has further exacerbated currency risk for businesses, leading to substantial financial losses and operational disruptions.”

He added that companies with large foreign currency liabilities face serious credit and liquidity risks as they are unable to fulfill their forward contracts.

He said, “This strains cash flow jeopardizes overall financial stability. While many small and medium-sized enterprises have been forced to close or temporarily suspend operations, larger corporations have incurred massive foreign exchange losses exceeding over N300bn in the second half of 2023. This situation has been exacerbated by the continuous depreciation of the naira, which has depreciated by more than 72 percent, from N450 to N1,600 per dollar over the past year.”

He noted that manufacturing has been hit even harder in the past six months, with businesses losing over 1.5 trillion naira in foreign exchange transactions.

He explained that to prevent further damage, the CBN, the Federal Ministry of Finance, and the private sector need to work together to develop a sustainable framework to settle open futures contracts and improve foreign exchange inflows.