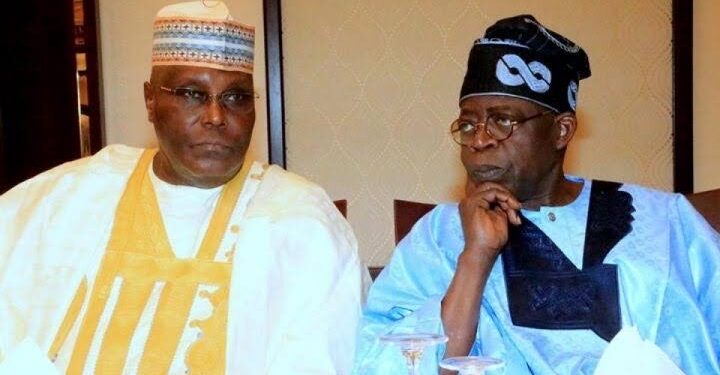

Former Vice President Atiku Abubakar has vehemently opposed the Nigerian government’s plan to utilize N20 trillion from pension funds for infrastructure projects.

Following the Federal Executive Council (FEC) meeting, the coordinating minister for the economy and minister of finance, Wale Edun, disclosed the government’s strategic plan to explore the possibility of utilizing locally available resources, such as pension funds, to support infrastructure development.

He emphasized the government’s commitment to utilizing domestic financial resources, specifically pension and life insurance funds, to mobilize local funds for national progress.

In response to this announcement, Mr. Abubakar expressed his disapproval on his verified social media platform, criticizing the plan as unlawful and warning of potential negative repercussions for pensioners. He referenced the Pension Reform Act of 2014 and regulations set by the National Pension Commission (PenCom), which restrict pension fund investments in infrastructure to a maximum of five percent of total assets.

He stated: “I have been made aware of a troubling revelation by the finance minister and coordinating minister of the economy, Wale Edun, during his address to state house correspondents following the federal executive council meeting at the Presidential Villa on May 14th.

“According to the minister, there is a proposal by the federal government to stimulate economic growth by unlocking N20 trillion from the nation’s pension funds and other funds to support vital infrastructure projects nationwide. While the minister anticipates that this initiative will eventually attract foreign investment interest, he currently prioritizes domestic savings.

“However, essential details, such as the proportion of funds to be extracted from pension funds, were not provided. Regardless, this endeavor must be immediately halted! It is a misguided venture that could have detrimental effects on the lives of hardworking Nigerian retirees who rely on their pensions for sustenance.

“The government must adhere strictly to the provisions of the Pension Reform Act of 2014 (PRA 2014) and the revised regulations on the investment of pension assets as stipulated by PenCom.

“The government must not contravene the existing regulations on investment limits, namely that pension funds are restricted to investing a maximum of five percent of total assets in infrastructure ventures. As of December 2023, total pension fund assets amounted to approximately N18 trillion, with 75 percent invested in FGN securities. There are no pension funds exceeding five percent of the nation’s total pension fund value for Mr. Edun to tamper with.

“Mr. Edun faces formidable challenges in funding infrastructure development in Nigeria. There are no shortcuts available to him.

“He must implement essential reforms to restore investor confidence in the Nigerian economy and capitalize on private resources, expertise, and technology.”

From: Nwakaji Peace Martins