By Vincent Amadi

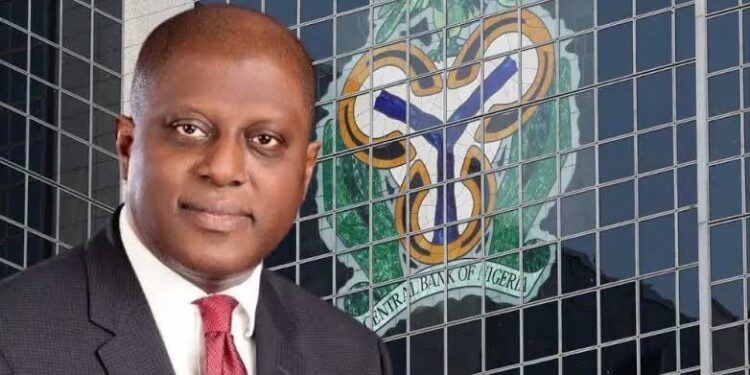

The Central Bank of Nigeria (CBN) has lifted the boycott on new account openings set on OPay, Moniepoint, Kuda, PalmPay, and Paga.

In April 2024, the CBN coordinated all five fintechs to delay onboarding new clients as a portion of endeavors to combat extortion within the industry.

“It is basic to emphasize that OPay entirely follows to the affirmed KYC confirmation forms and inclinations our regarded clients to guarantee that the due confirmation forms is taken after for all accounts and all prerequisites are totally satisfied,” an explanation on OPay’s social media handles stated.

Lifting the boycott might be connected to the fintechs fulfilling KYC guidelines required by the CBN. In April 2024, the CBN solidified 1,146 bank accounts connected to unapproved forex exchanges. In May, the neobanks met with the National Security Consultant (NSA), the Financial and Money Related Violations Commission (EFCC), and the CBN to talk about lifting the boycott on modern client onboarding.

Authorities commanded the neobanks to confine peer-to-peer crypto exchanges. They were also reaching to upgrade client points of interest and require bank confirmation or national character numbers for all layered accounts.

This was taken after a December 2023 mandate that orders substantial recognizable proof for all account types to fortify KYC forms, which were at first loose to advance financial incorporation.

Thus, PalmPay presented facial confirmation and started physically going to vendors to confirm their addresses, whereas Kuda asked clients to transfer verification of their domestic addresses.

OPay moreover actualized physical address confirmation for all shippers utilizing OPay Trade, with staff going to areas to help with the method. Vendors were prompted to be security cognizant and confirm the character of the workforce conducting the confirmation to avoid pantomime or extortion.

This news will come as a relief for the neobanks, who have seen operations disturbed since the boycott was put, but it still casts a shadow on the country’s regulatory scene.