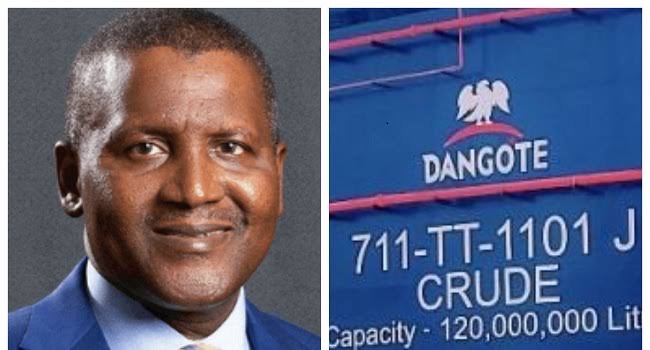

Dangote Industries Limited (DIL) has dismissed the claim by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) that International Oil Companies (IOCs) are willing to sell crude oil to domestic refineries.

Dangote argues that IOCs make it harder to access local crude oil, often forcing them to use expensive middlemen and pay inflated prices.

DIL, Vice President Devakumar Edwin has directly refuted the statement by NUPRC CEO Gbenga Komolafe that the Petroleum Industry Act (PIA) guarantees a “willing buyer-willing seller relationship” for crude oil.

Edwin argues that only Sapetro sells directly to DIL, while other producers are dependent on trading companies outside Nigeria, incurring unnecessary costs.

Edwin said, “The NUPRC has been very supportive to the Dangote Refinery as they have intervened several times to help us secure crude supply. However, the NUPRC chief executive was probably misquoted by some people hence his statement that IOCs did not refuse to sell to us. To set the records straight, we would like to recap the facts below.”

He explained how only one local producer, Sapetro, sold directly to DIL while other producers referred them to international trading units that acted as costly middlemen.

“These international trading arms are non-value adding middlemen who sit abroad and earn margin from crude being produced and consumed in Nigeria. They are not bound by Nigerian laws and do not pay tax in Nigeria on the unjustifiable margin they earn,” Edwin said.

Edwin reported a case where the commercial unit of IOC refused to sell directly and insisted on the use of middlemen, leading to nine months of negotiations before NUPRC stepped in. He also noted that international trading units favour foreign buyers such as Indonesia’s Pertamina, often keeping Nigerian refineries waiting.

“The trading arm of one of the IOCs refused to sell to us directly and asked us to find a middleman who will buy from them and then sell to us at a margin. We dialogued with them for 9 months and in the end, we had to escalate to NUPRC who helped resolve the situation,” he revealed.

He noted that IOCs have consistently denied the company access to local crude, often offering it at a premium of $2 to $4 per barrel over the official NUPRC price.

Edwin stressed that these prices are higher than the market prices tracked by platforms such as Platts and Argus, and urged DIL to refer the matter to NUPRC.

Edwin called on the NUPRC to reconsider its pricing policy, stressing that market liquidity is essential to realize fair prices under the willing buyers and sellers model.

Edwin opined that the current gap in domestic crude oil supply commitments should not prevent prudent measures to ensure fair prices and availability.

“We hope NUPRC addresses these pricing issues to prevent price gouging and ensure a transparent and efficient crude supply system,” he explained.