The Federal Competition and Consumer Protection Commission (FCCPC) has introduced new regulations to address harassment, data breaches, and exploitative practices in Nigeria’s digital lending space.

In a statement on Wednesday, the FCCPC said the digital, electronic, online, or non-traditional consumer lending regulations, 2025 — also known as the DEON consumer lending regulation — were officially gazetted and took effect on July 21.

The FCCPC said the rules, issued under the Federal Competition and Consumer Protection Act (2018), will serve as a comprehensive framework for registration, transparency, and ethical loan recovery.

The commission said the document is also the framework for data privacy and responsible lending across all unsecured consumer credit offered through electronic and non-traditional channels.

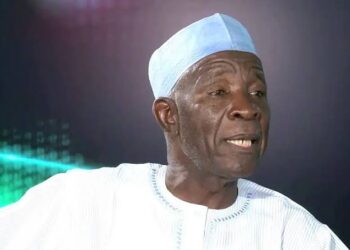

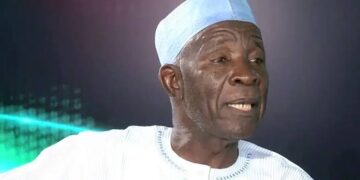

Tunji Bello, executive vice-chairman and chief executive officer (CEO) of the FCCPC, stated that the new regime will end abusive practices in the sector.

“For too long, Nigerians have endured harassment, data breaches, and unethical practices by unregulated digital lenders,” Bello said in Abuja on Wednesday.

“These regulations draw a clear line that innovation is welcome, but not at the expense of the rights and dignity of consumers, or the rule of law.

“No consumer should be harassed, defamed, or lured into unsustainable debt under the guise of digital lending.”

The FCCPC said the regulation prohibits pre-authorised or automatic lending, compels lenders to provide clear and accessible loan terms, and bans unethical marketing.

“It also makes joint registration mandatory for partnerships, requires at least one locally owned service provider in airtime and data lending, and bars monopoly or dominance agreements without prior FCCPC approval,” the commission added.

“Under its provisions, all digital lenders must register with the FCCPC within 90 days of commencement. Approval is dependent on meeting consumer protection, data compliance, and transparency standards.

“Non-compliant operators face sanctions, which may include fines of up to N100 million or 1% of turnover, as well as potential disqualification of directors for up to five years.”

The commission urged mobile money operators (MMOs), digital money lenders (DMLs), and other service partners to obtain registration forms and compliance guidelines via its website.

The FCCPC also advised customers to report unregistered lenders, unfair interest rates, or privacy violations through the commission’s complaint portal: lenderstaskforce@fccpc.gov.ng.