In recent years, Nigeria has faced a series of economic challenges, but none as pervasive and damaging as the relentless rise in inflation. With inflation rates soaring to alarming levels, many Nigerians are feeling the pinch of soaring prices for basic goods and services. From food to transportation, and even everyday household items, the purchasing power of Nigerians has diminished significantly.

Inflation, in simple terms, is the rate at which the general level of prices for goods and services rises, and, subsequently, the purchasing power of money falls. In Nigeria, inflation has been on an upward trajectory for the past several years, largely driven by factors like the fuel prices, exchange rate, especially customs excise duty rates on essential goods. The immediate effect is the twin policy of subsidy removal and unification of the exchange rate by President Tinubu. The situation worsened when the country faced a currency crisis, which led to the depreciation of the Naira, further exacerbating the cost of imported goods and services.

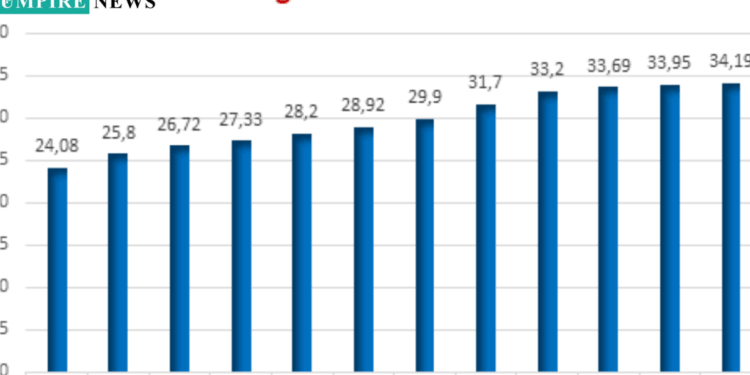

As of the latest reports, Nigeria’s inflation rate has surpassed 30%, a level not seen in decades. Food inflation has been particularly severe, with staple food items such as rice, maize, and cooking oil becoming prohibitively expensive. This has had an excruciating effect on households, especially those in lower-income brackets, as food constitutes a significant portion of their spending. The cost of transportation has also surged, with fuel prices rising to new heights, making it more expensive for Nigerians to commute to work or run errands.

The effects of high inflation are visible across every facet of daily life in Nigeria. Families, who once could afford to feed their children three meals a day, now struggle to put enough food on the table. The rising cost of essential food items has forced many households to cut back on their consumption, leading to malnutrition in some cases. The World Bank has even warned that inflation has pushed millions of Nigerians into poverty, worsening an already dire situation.

The country’s middle class, already squeezed by the high cost of living, has found it increasingly difficult to maintain their standard of living. With wages remaining stagnant, many workers are unable to keep up with the rising cost of goods and services. This has led to a decline in the quality of life for many Nigerians, who are now forced to make difficult decisions, such as whether to buy food or pay for healthcare.

For businesses, the high inflation rate has created an environment of uncertainty. Manufacturers and service providers face increased production costs due to rising prices for raw materials, fuel, and transportation. This has resulted in a slowdown in economic growth, as businesses struggle to maintain profitability. Small and medium-sized enterprises (SMEs), which are the backbone of the Nigerian economy, have been hit the hardest, with many being forced to lay off workers or close down altogether.

The Central Bank of Nigeria (CBN) plays a key role in managing inflation in the country. One of its primary tools for controlling inflation is the adjustment of interest rates. By raising interest rates, the CBN can reduce the amount of money in circulation, thereby curbing demand and slowing down inflation. However, this approach can also have negative consequences, such as increasing the cost of borrowing and stifling investment.

In the face of rising inflation, the CBN has taken a number of steps to try and curb the situation, including hiking interest rates and implementing various monetary policies. While these measures are necessary, they have not been sufficient to bring inflation under control. Experts argue that the CBN needs to adopt a more comprehensive and coordinated approach, working alongside other government agencies, such as the Ministry of Finance, to tackle the root causes of inflation.

One of the biggest challenges the CBN faces is the instability of the Naira. The country’s exchange rate has fluctuated wildly in recent years, and the depreciation of the Naira has contributed significantly to inflation. When the value of the Naira falls, the cost of imported goods rises, further driving up prices. The CBN must find a way to stabilize the Naira and ensure that foreign exchange reserves are sufficient to meet the country’s import needs.

While the CBN plays an important role in managing inflation, the federal government must also take a more proactive stance in addressing the issue. The government must adopt policies that tackle the root causes of inflation, such as inadequate infrastructure, corruption, and the over-reliance on imports.

A key factor driving inflation in Nigeria is the country’s dependence on imports, particularly in the food and energy sectors. With the Naira constantly under pressure, importing goods becomes more expensive, driving up prices for consumers. The government needs to prioritize policies that promote local production and reduce the country’s dependence on imports. This includes investing in agriculture, manufacturing, and energy production, as well as creating an enabling environment for businesses to thrive.

Additionally, Nigeria’s energy crisis, particularly the constant power outages, is another major contributor to inflation. Many businesses rely on generators to power their operations, and with the high cost of fuel, this adds to production costs. The government must invest in improving the country’s power infrastructure to reduce the reliance on expensive fuel-powered generators.

Corruption also plays a significant role in driving up inflation in Nigeria. Funds meant for infrastructure development and social services are often misappropriated, and this has had a negative impact on the economy. The government must take strong action to address corruption and ensure that public funds are used for their intended purpose.

The Ministry of Finance also has a critical role to play in addressing Nigeria’s inflation crisis. In addition to working with the CBN on monetary policy, the Ministry must ensure that fiscal policies are aligned with efforts to combat inflation.

One of the most important steps the government can take is to address the issue of fuel subsidy removal effects on the masses. The palliatives strategy in this regard has failed woefully. While this is a contentious issue, the fact remains that the subsidy removal on fuel, electricity, and education has further plunged Nigerians into untold hardship and poverty, hence th stampedes witnessed during the festive season, last year December across the country, with recorded deaths. The government must find a way that protects the most vulnerable Nigerians while addressing the long-term economic benefits of subsidy removal. In the present, it seems no benefit accrues to the masses other than increased allocation to States and Local government councils, which barely trickle down to the masses.

Furthermore, the Ministry of Finance must work to improve transparency and accountability in the management of the country’s resources. Effective budget planning, proper allocation of funds, and tackling corruption are essential to reducing the inflationary pressure on the economy.

The high inflation rate in Nigeria is having a devastating effect on the lives of millions of Nigerians, and the time to act is now. The Federal Government, the Central Bank of Nigeria, and the Ministry of Finance must work together to implement policies that address the root causes of inflation and provide relief to the Nigerian people. From stabilizing the Naira to promoting local production and addressing corruption, the government must take bold and decisive action to combat inflation. Failure to do so could result in even greater economic hardships for the country.