Nigeria’s Federal Government has announced plans to boost the economy by reducing corporate taxes, offering single-digit interest rates, and funding local manufacturing. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, shared this vision at Access Bank’s 2024 Corporate Customer Forum in Lagos.

He said the goal is to create an enabling environment for the private sector through long-term low-interest rates, 25-year mortgages, and manufacturing support.

Edun explained that the government will introduce consumer credit schemes to facilitate the purchase of durable goods, thereby stimulating the manufacturing sector. Corporate income tax will also be reduced to free up capital for businesses and encourage investments.

Additionally, the tax burden will shift to high-end consumption, with increased taxes on luxury goods, while essential items like food and pharmaceuticals will be exempt from Value Added Tax (VAT).

Aliko Dangote, Africa’s richest man, praised the government’s efforts but emphasized the need for stronger domestic investments. He stressed that local industries must be supported to create jobs and reduce reliance on imports. Dangote also highlighted the importance of protecting small and medium-scale enterprises (SMEs) from unfair competition with foreign manufacturers.

The government has acknowledged the role of SMEs in Nigeria’s economy and has introduced interventions such as N50,000 grants for small businesses and 9% loans for larger SMEs. The economic strategy has been developed in consultation with key stakeholders, including the Manufacturers Association of Nigeria (MAN), the Nigerian Economic Summit Group (NESG), and state governments.

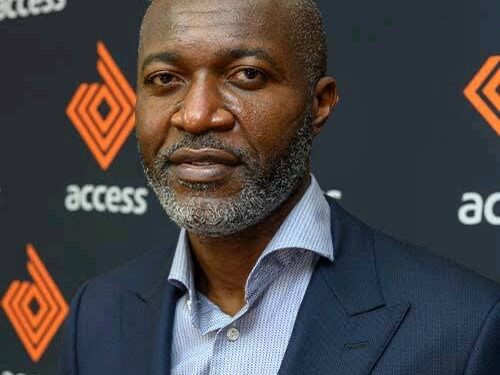

On the other hand, Roosevelt Ogbonna, the Managing Director of Access Bank Plc, noted that Nigeria is not alone in facing economic challenges, as many emerging and global markets are also struggling. Bismarck Rewane, CEO of Financial Derivatives Company Limited, projected that Nigeria’s economy will grow at 3.5% by 2026, reaching approximately $400 billion, and becoming the second-largest economy in Sub-Saharan Africa.

However, he added that the remaining challenges include, high electricity tariffs and rising telecom tariffs. On the positive side, the foreign exchange market will see an efficient auction system and unencumbered foreign reserves will stabilize at $20 billion. Inflation is forecast to decline to 22%, allowing the Monetary Policy Rate to drop to 20% per annum.

Uche Uwaleke, the Director of the Institute of Capital Market Studies at Nasarawa State University, emphasized the need for rapid growth in the capital market to meet the Capital Market Master Plan’s target of 25% by 2025. He recommended that the government focus more on infrastructure bonds to enhance infrastructure and reduce the country’s rising debt burden.