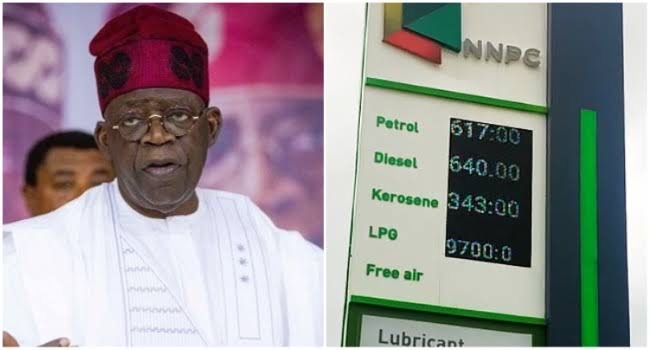

Premium Motor Spirit (PMS), also known as fuel, is set to be sold at a price of N1,300 per litre, mainly due to the liquidity crisis suffered by the Nigerian National Petroleum Corporation (NNPC) Limited, Journalists’ investigations have revealed.

NNPC, the sole importer of fuel in Nigeria, has always denied subsidizing the cost of PMS but has also refused to disclose the landed cost of the product.

However, on Sunday, NNPC admitted that it is facing financial difficulties due to the cost of shipping PMS.

The landing cost of fuel, which includes the international price of the product, transportation, insurance, and other costs, has risen to N1,203 per litre from N720 per litre in October 2023. If NNPC stops paying petrol subsidy, which is likely to happen, PMS price will settle between N1,300 and N1,350 per litre, market players told Journalists.

An independent oil marketer, who preferred anonymity, said, “It was almost inevitable for the pump price to remain the same, as this is one of the outcomes of a fully deregulated market.

“The NNPCL remains the main importer, with private importation remaining limited. This situation is worsened by Nigeria’s declining crude oil output, which impacts the country’s capacity to import refined products,” the marketer said.

Tunji Oyebanji, the chief executive officer of 11 Plc (formerly Mobil Nigeria), said selling below cost price, whether it be imports or local refineries, is not sustainable.

“If they sell at an economic price, perhaps others can import, supply will improve, and the financial strain will not be on them alone. It’s either that or these supply disruptions will continue indefinitely. I am baffled that they have not been upfront about this since instead of denials,” Oyebanji said in a note.

Further findings showed that the 1,203 naira landed cost does not include Nigerian Ports Authority charges, vessel charges, Nigerian Maritime Safety Authority charges, and other logistical costs.

Some of these charges are calculated in dollars, which some experts have called for a review to reduce gas prices.

National President, Petroleum Products Retail Shop Owners Association of Nigeria (PETROAN), Gillis Harry, told Journalists that Nigerians may not expect an immediate reduction in petrol prices given the current landed cost of refined products. He said the recent developments in the NNPC debt situation indicate the need for swift action to ensure the country’s refineries are on board and operating optimally.

“Right now, there is no PMS anywhere in the world that can be sold for less than $1. You can see that with the Naira exchange rate. That’s why we can’t sell this product for less than 1,200 Naira,” he said.

President of the Independent Petroleum Marketers Association of Nigeria (IPMAN), Abubakar Maigandi, said the NNPC issue should not affect the country’s fuel supply if only other traders were given the right to import refined products.

He explained that the association is continuing to hold talks with the government to explore ways to address the shortage by allowing its members to import gasoline into the country.

“What we are telling Nigerians is that there is no need for panic. As marketers, we have petrol for sale but not the quantity that we should have. Our stock is a bit down, but some marketers are still selling,” Maigandi said. Nigeria’s high loans delay the dream of world-class healthcare.

On Monday, Dangote Refinery announced it had started trading gasoline as NNPC is set to be the first exclusive buyer of its product. The Dangote plant is on the brink of producing a ton of gasoline that will hit the market this week, according to two people familiar with the matter.

Key to the plant’s gasoline production is a unit called a reformer that produces blends for road fuels, the people told Bloomberg.

“This reformer started operating, with gasoline production expected to begin by the end of the week,” one of the people said. Another source said gasoline would hit the market this week.

Dangote’s production will have a billion-dollar impact on fuel trade in and around the region. Nigeria received nearly 250,000 barrels per day of gasoline last year, mostly from Europe, according to data from analytics firm Vortexa.

Devakumar Edwin, vice president of Dangote Industries Limited, told Reuters: “We are testing the product (petrol), and subsequently it will start flowing into the product tanks”.

He did not say exactly when the gasoline would be available in the local market.

Edwin said NNPC Ltd, Nigeria’s sole gasoline importer, would buy the gasoline exclusively.

“If no one is buying it, we will export it as we have been exporting our aviation jet fuel and diesel,” Edwin said.

The recent announcement that the state oil company will be the sole purchaser of gasoline from the Dangote refinery could bring much-needed relief to the NNPC, which is currently struggling with its international obligations to oil traders.

If the Dangote refinery exclusively supplies to the NNPC, it will significantly reduce import and logistics costs and allow local traders to buy gasoline from the NNPC at market prices. The agreement could also address the ongoing fuel shortage that has plagued the country for more than a month, although the state oil company has made little progress.

“The news that Dangote is processing gasoline couldn’t come at a more crucial time, given the NNPC’s statement about its difficulties securing imported supply due to financial strain,” Clementine Wallop, sub-Saharan Africa at political risk consultancy Horizon Engage, told Journalists.

She said this “prompts the question of how NNPC will manage purchasing from Dangote, and impresses the need for greater transparency in its finances.”

According to Journalists’ findings, most petrol stations in Abuja and Lagos remain closed, with commercial motorists and private vehicle owners lining up at the few that remain open.

In Ikeja, Ikorodu, and other parts of Lagos, petrol prices have risen to as much as 1,000 naira per litre, intensifying the scramble for fuel. This worrying trend is also evident in Ogun state and the state capital, Abuja.