In the first half of 2024, Nigeria witnessed a remarkable surge in its total capital importation, which amounted to $5.98 billion. This figure was divided into two quarters; $3.37 billion was recorded in the first quarter of the year, while the second quarter saw $2.60 billion in capital inflow.

The total capital importation of $5.98 billion for the first half of 2024 marks a substantial 176% increase when compared to the capital importation levels during the same period in 2023.

To put this into perspective, in the first quarter of 2023, the capital importation was lower, standing at only $1.13 billion, with a slight decline in the second quarter to $1.03 billion.

Together, these amounts resulted in a total of $2.16 billion for the first half of 2023, highlighting the stark contrast to the figures for 2024.

The remarkable rise in capital importation for the first six months of 2024 can largely be attributed to the 750 basis points increase in interest rates, a strategy implemented to combat rising inflation.

This adjustment created an attractive environment for Foreign Portfolio Investments (FPIs), drawing substantial interest into the Nigerian money market.

However, it is worth noting that the capital importation directed towards the real economy, particularly through Foreign Direct Investments (FDIs), faced challenges, plummeting to a record low of only $29 million in the second quarter of 2024.

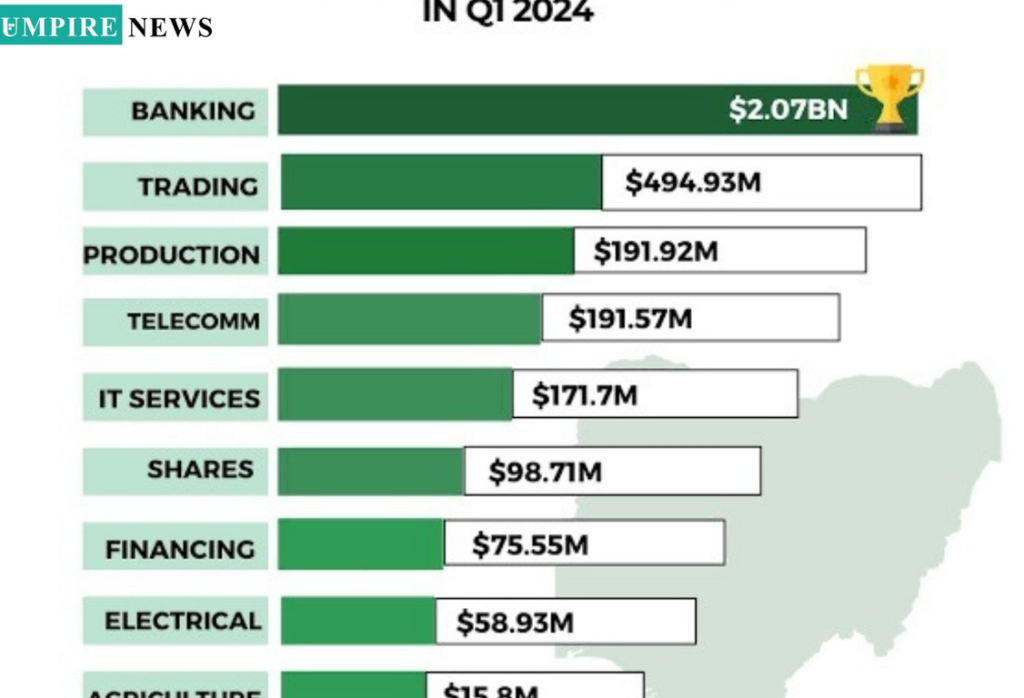

Below are the ten sectors that attracted the highest capital importation between January and June 2024:

10. Transport: The transport sector managed to attract $19.05 million in total capital importation during the first half of 2024. Notably, capital inflow in this sector rose from $5.05 million in the first quarter to $14 million in the second quarter.

09. Agriculture: Despite its contribution of approximately 23% to Nigeria’s overall economy, the agricultural sector attracted only $21.72 million in foreign capital during the first half of 2024. The second quarter saw a decrease in capital importation, dropping to $5.91 million from $15.80 million in the first quarter.

08. Electrical: The power sector experienced total capital imports of $85.44 million in the first half of 2024. However, this sector saw a decline in capital importation, decreasing from $58.93 million in Q1 to $26.51 million in Q2.

07. Financing: This sector also experienced a reduction in capital importation in the second quarter compared to the first quarter. The overall capital importation for the financing sector in the first half of the year amounted to $115.99 million.

06. I.T Services: The IT services sector faced a nearly 100% decline in capital importation during the second quarter, dropping from $171.70 million in Q1 to a total of $172.44 million for the first half of the year.

05. Shares: Capital importation into shares in Nigeria reached $176.72 million in the first half of 2024. In the first quarter, the sector attracted $98.71 million, but this figure fell to $78.01 million in the second quarter.

04. Telecommunications: The telecommunications sector also saw a decrease in capital importation, declining from $191.57 million in Q1 to $113.42 million in Q2. The total capital importation for this sector from January to June was $304.99 million.

03. Production and Manufacturing: Despite facing economic challenges, the production and manufacturing sector recorded $816.62 million in capital importation during the first six months of 2024.

Unlike other sectors that experienced declines, this sector saw a remarkable 225% increase, with capital importation rising from $191.92 million in Q1 to $624.71 million in Q2.

02. Trading: Contributing hugely to the overall capital inflow, the trading sector accounted for 17.7% of the total capital importation in the first half of the year, reaching an impressive $1.06 billion.

01. Banking: Consistently a leader in attracting foreign capital, the banking sector saw capital importation reach $3.19 billion in the first half of 2024. This amount represents approximately 53.36% of the total capital importation during this period, underscoring the sector’s vital role in Nigeria’s financial landscape.

In summary, the first half of 2024 has been marked by an increase in capital inflows into Nigeria, driven largely by portfolio investments while direct investments into the real economy face challenges.

The impressive growth across various sectors indicates a dynamic economic landscape, albeit with areas needing attention, particularly in securing Foreign Direct Investment to support sustainable development.