By: Vincent Amadi

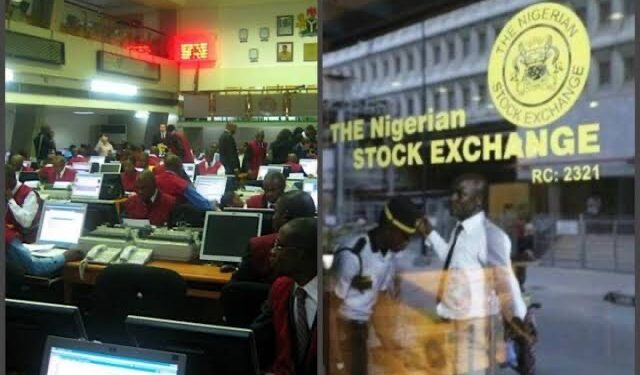

For the fourth consecutive day, the domestic stock exchange widened its losses by 57 billion naira due to the selling off of FBN Holdings, Access Corporation, Transnational Corporation, and others.

Specifically, market capitalization opened at 55,188 billion naira and closed at 55,131 billion naira, down 57 billion naira (0.10%).

The All Share Index also fell 0.10% (99.24 points) from Wednesday’s 97,199.6 points to close at 97,100.36. As a result, the year-to-date (YTD) return fell to 29.86%.

Meanwhile, market breadth ended in the negative with 31 decliners and 14 gainers on the floor. Oando topped the list of losers, losing 9.94 percent to N32.60.

This was followed by ABC Transport, which fell 9.52 percent to N76,000 per share.

Guinea Insurance fell 9.09 percent to N40,000 per share, Livestock Fees Ltd, fell 9.09 percent to N2.20, and Computer Warehouse Group, fell 7.69 percent to N5.40 per share.

Meanwhile, Neimeth led the list of gainers, increasing 9.55 percent to close at N2.18, followed by Total Plc, which increased 8.82 percent to close at N511.9 per share.

AIICO rose by 6.54% to close at N1.14 naira per share, C&I Leasing gained by 6.07% to close at N2.97 naira per share while UPDC gained by 4.92% to close at N1.28 naira per share. Analysis of market activities shows that trading volume declined compared to the previous session, with the value trading down by 35.71 percent.

A total of 271.26 million shares worth 3.52 billion naira were traded in 7,233 transactions, compared to 315.3 million shares worth 5.48 billion naira traded in 8,365 transactions last time.

Veritas Capital led the way in terms of volume with 33.38 million shares worth 40.73 million naira, followed by Sterling Nigeria with 16.65 million shares worth 65.86 million naira.

AIICO traded 16.37 million shares valued at NGN18.32 million, RT Briscoe traded 16.17 million shares valued at NGN28.56 million while GTCO was the top trader with 15.94 million shares valued at NGN725 million.