The approval granted by President Bola Tinubu for the sale of crude oil to the Dangote Petroleum Refinery in naira has been recognized by oil marketers, refiners, and experts as a significant development that is expected to lead to a reduction in the prices of domestically refined petroleum products.

This decision is anticipated to enhance the operations of domestic refineries, bolster the nation’s foreign exchange reserves, and provide support for the strengthening of the naira. Stakeholders in the downstream oil sector have expressed their approval of the President’s directive, highlighting the positive impact it is expected to have on the industry.

They have also commended the role of the media in bringing attention to this matter, emphasizing the importance of Nigerian refineries not facing challenges in accessing the United States dollar for the procurement of a commodity that is readily available within the country.

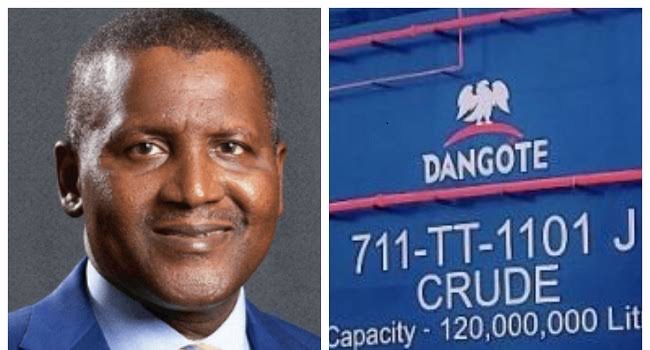

President Tinubu’s decision to instruct the Nigerian National Petroleum Company Limited to sell crude to the Dangote refinery and other upcoming refineries in naira was officially announced by the Special Adviser to the President on Information and Publicity, Bayo Onanuga.

This directive, which was approved by the Federal Executive Council on Monday, aims to ensure the stability of the pump price of refined fuel and the exchange rate between the dollar and the naira. It is worth noting that the Dangote refinery has previously encountered difficulties in securing crude oil supply from the International Oil Companies operating in Nigeria.

Some conflicts have arisen between the country’s midstream/downstream regulator and a 650,000 barrels per day refinery. Earlier this year, the refinery received crude oil from NNPC and a few IOCs. However, it later raised concerns that IOCs were reluctant to supply crude to the plant, forcing it to resort to significant importation of crude oil. The Dangote refinery currently requires approximately 15 cargoes of crude oil annually, amounting to about $13.5 billion.

While NNPC has committed to supplying four cargoes, the President has recently issued an order for the supply of this product to be conducted in naira rather than dollars, with the intention of supporting not only the Dangote refinery but also other domestic refineries.

The Federal Executive Council has approved that the supply of 450,000 barrels for domestic consumption be offered to Nigerian refineries in naira, with Dangote refinery being used as a pilot for this new approach.

In a statement titled “President Tinubu offers a lifeline to Dangote refinery, NNPC to sell crude to it in naira,” the presidential media aide announced that to ensure fuel price stability and exchange rate certainty, the Federal Executive Council has endorsed President Tinubu’s proposal to sell crude oil to Dangote refinery and other upcoming refineries in naira.

The Nigerian National Petroleum Corporation (NNPC) has announced its plans to supply 450,000 barrels of crude oil per day worth $13.5 billion annually to local refineries in Nigeria. The Federal Executive Council (FEC) has approved the decision for the crude oil meant for domestic consumption to be sold in naira to Nigerian refineries, with the Dangote refinery chosen as the pilot for this initiative. It has been decided that the exchange rate for this transaction will be fixed for the duration of the deal.

The African Export-Import Bank (Afreximbank) and other settlement banks in Nigeria will facilitate trade between Dangote and NNPC Limited. This intervention will eliminate the necessity for international letters of credit and lead to significant savings for the country in importing refined fuel.

Furthermore, Mr. Zacch Adedeji, the President’s Special Adviser on Revenue and Chairman of the Federal Inland Revenue Service emphasized the importance of this development in mitigating Nigeria’s heavy reliance on foreign exchange for crude oil imports, which currently accounts for approximately 30 to 40 percent of its foreign exchange expenditure. By denominating crude oil transactions in the local currency, the government expects to substantially reduce its foreign exchange burden, resulting in estimated annual savings of $7.3 billion.

Additionally, this initiative is projected to reduce monthly foreign exchange expenditure on petroleum products from approximately $660 million to $50 million. Mr. Adedeji emphasized the significant impact of these measures, highlighting the potential $7.92 billion in annual savings from the monthly expenditure on petroleum products.

The Council has approved a new regime for the importation of petroleum products, which will be implemented by a settlement bank, Afrieximbank, acting as the lead arranger between NNPC and the Dangote refinery. The President Tinubu Government is expected to stabilize pump prices by aligning importation costs with local consumption levels. It is anticipated that this will reduce forex fluctuations and provide economic predictability.

The benefits of this new regime include a significant reduction in forex pressure, with the current monthly expenditure of $660m expected to decrease to a maximum of $50m per month, resulting in an annual saving of $7.32bn.

Additionally, finance costs are expected to decrease from $79m to a lower amount. This new approval marks a significant step towards more efficient and cost-effective petroleum product importation processes. The government should work closely with other important agencies to address this issue.