The House of Representatives has moved as a matter of urgency to address issues raised by Dangote Refineries over IOC’s deliberate attempts to frustrate its operations

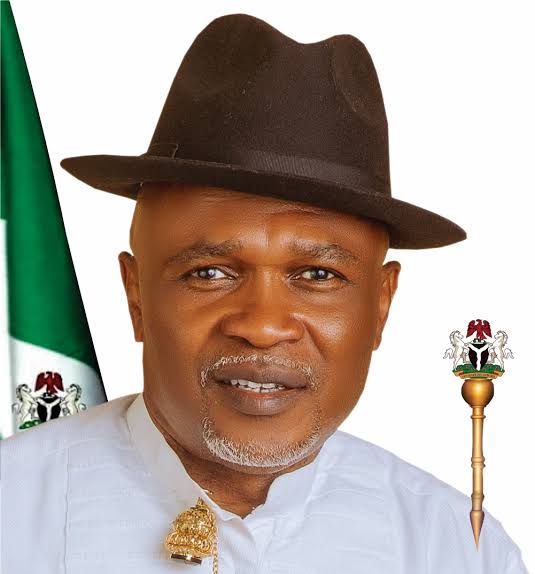

The House of Representatives Minority Leader, Kingsley Chinda raised the issue during plenary on Thursday, declaring it as a matter of national urgency. The lower chamber expressed concern over potential manipulation of the price of local crude oil, which could be hindering the Dangote refinery from procuring locally and impacting the cost of refined products. The lawmakers also announced their intention to investigate the actual percentage of the Federal Government’s shares in the Dangote refinery. It was noted that Dangote had indicated that Nigeria only owns 7.3% of the refinery, contrary to the claimed 20% stake, as the Federal Government has reportedly failed to fulfill its obligations. Consequently, the House urged the Ministry of Petroleum Resources to intervene in the situation to ensure the success of the Dangote refinery for the benefit of the nation.

The management of the refinery once again on Wednesday accused the International Oil Companies (IOCs) of hindering its operations by insisting on selling crude oil to the refinery through their foreign agents. The company stated in a press release that the local price of crude oil will continue to rise due to the fact that these trading arms are offering cargoes at a premium of $2 to $4 per barrel above the official price set by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

The Vice President of Oil & Gas at Dangote Industries Limited, Mr. DVG Edwin, expressed appreciation for the interventions made by NUPRC in addressing the oil company’s requests for crude supply from IOCs and for the publication of the Domestic Crude Supply. The company has raised concerns that foreign oil producers appear to be prioritizing Asian countries over Nigeria when selling the Crude oil they produce, leading to an increase in the local price of crude due to the higher prices offered by trading arms. As an example, the company mentioned that they paid $96.23 per barrel for a cargo of Bonga crude grade in April, excluding transport costs, with the price consisting of $90 at the base rate. In the same month, we were able to purchase WTI at a dated Brent price of $90.15 plus a trader premium of $0.93 inclusive of transportation costs. When NNPC later reduced its premium in response to market feedback indicating it was excessive, certain traders began requesting a premium of up to $4 million above the NSP for a cargo of Bonny Light.