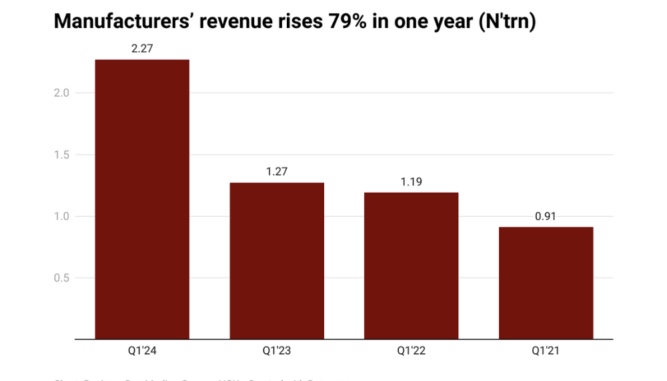

According to data compiled by Journalists, the combined sales of some of Nigeria’s largest manufacturers grew 78.7% in the first quarter of 2024.

The latest annual financial statements of 13 listed consumer goods companies show that first-quarter sales rose to 2.27 trillion naira from 1.27 trillion naira in the same period last year. This is higher than 6.7% (1.19 trillion naira) in the first quarter of 2022.

The companies are Dangote Cement Plc, BUA Foods Plc, Nigerian Breweries Plc, Nestle Nigeria Plc, BUA Cement Plc, Lafarge Africa Plc, Dangote Sugar Refinery Plc, International Breweries Plc, Guinness Nigeria Plc, Unilever Nigeria Plc, Cadbury Nigeria Plc, NASCON Allied Industries Plc and Champion Breweries Plc.

However, despite the increase in sales, most of the companies recorded a decline in revenue due to the devaluation of the naira.

Damilare Asimiyu, macroeconomic strategist and head of investment research at Afrinvest West Africa Limited, said, “Companies’ revenue will still grow because our local productivity is still short of demand and the population is still growing.”

He said most Nigerian companies have learned a lot about managing logistics costs during the COVID-19 pandemic and many of them have formed many partnerships to help with sourcing raw materials. They would also have significantly reduced their reliance on imported raw materials.

“Breweries and consumer firms are now sourcing their materials locally, but the 30-40 percent they’re still exposed to externally is what affected them. So, fix the environment, don’t let finance costs be high, and businesses will do well.”

Gabriel Idahosa, president of the Lagos Chamber of Commerce and Industry said it would be great if the country did not have FX problems.

“First, they will not require so much naira and borrowing to buy a dollar now. They are also paying a lot of interest to buy the same dollar. So, both the volume of working capital and the rate of interest they are paying on the naira they are borrowing would have been lower making their profit performance much better,” he added.

Further analysis of the statement shows that Dangote Cement recorded the highest turnover of 817.4 billion Naira, followed by BUA Foods with 356.9 billion Naira, Nigerian Breweries (227.1 billion Naira), Nestle (183.5 billion Naira) and BUA Cement (161.1 billion Naira).

“I believe that if not for the FX in terms of profitability, manufacturers would have performed much better because the FX component of that cost would be less,” said Muda Yusuf, CEO of the Centre for Promotion of Private Enterprise (CPPE).

Seven of these companies – International Breweries, Cadbury Nigeria, Nigerian Breweries, Nestle, Dangote Sugar, Champion Breweries, and Guinness Nigeria – recorded losses totaling N388.6 billion in the first quarter.

Of the remaining six, three – BUA Cement, Lafarge Africa, and NASCON – reported declines in profits of 37.6%, 65.2%, and 24.9% respectively. The remaining three companies recorded increases in profits. These include BUA Foods, Unilever Nigeria, and Dangote Cement, which recorded a combined profit of N171.9 billion (compared to N152.6 billion last year).

Analysts say the further devaluation of naira and the rising interest rates are raising operating costs for companies, especially multinationals that incur most of their costs in foreign currencies.

The naira has already been devalued by 40 percent in June last year and has been devalued by almost 30 percent this year.

The devaluation of the naira will further squeeze profits for companies already struggling with double-digit inflation and weak purchasing power among cash-strapped consumers.

“A lot of consumer firms had higher finance costs because of FX losses and higher interest rates,” said Ayorinde Akinloye, a Lagos-based investor relations analyst.

“Despite some of them having good operating performance, their profit declined while others recorded huge losses,” Akinloye said.

The loss impacted tax payments to the Federal Government as manufacturers’ contributions fell to a three-year low in the first quarter of 2024. According to the latest Corporate Income Tax (CIT) report from the NBS, tax revenues from domestic and foreign manufacturing in the first quarter fell 70.4% to N43.2 billion compared to N145.1 billion in the same period last year.

Managing Director and Managing Director of Coleman Technical Industries Limited, George Onafowokan, said the high level of currency volatility and uncertainty was problematic for many businesses.

“You will limit what you have been able to do or limit your exposure. The erosion of working capital for businesses, especially for manufacturers, is happening massively.”

In the past eight years, Africa’s most populous country has fallen into two recessions due to the collapse of oil prices, the disruption caused by the COVID-19 pandemic, and the government’s failure to reform the economy.

President Bola Tinubu, who took office last May, implemented bold reforms, including removing gasoline subsidies and devaluing the naira, to raise revenue for the benefit of the people.

But the reforms have pushed inflationary pressures to record levels, reducing consumers’ purchasing power while businesses suffer rising operating costs.

Headline inflation rose for the 17th consecutive month to 34.19 percent in June, up from 33.95 percent in May, according to data from the National Bureau of Statistics.

Food inflation, which accounts for more than 50 percent of overall inflation, also rose to 40.87 percent from 40.66 percent. Rising inflation and slowing growth in one of Africa’s largest economies have led to the number of people living in poverty rising to 104 million by 2023 from 89.8 million at the start of the year, according to the World Bank.