As the controversial tax reform bills continue to court uproar and dissent, especially in the North, Southern lawmakers in the National Assembly have wholly endorsed it. Although the Senate has passed the tax reform bills for Second Reading, dialogue and arguments on different positions continue to emanate daily.

President Tinubu through the Presidential Committee on Fiscal Policy and Tax Reform had submitted four tax reform bills to the national assembly. The four bills include: the Joint Revenue Board of Nigeria (Establishment) Bill, 2024; Nigeria Revenue Service (Establishment) Bill, 2024; Nigeria Tax Administration Bill, 2024; and Nigeria Tax Bill, 2024.

Journalist Adam Mosadioluwa reported the following arguments as key merits of the tax reform bills put forward by the Presidential Committee on Fiscal Policy and Tax Reform, “the proposed bills aim to ensure uniformity in tax revenue administration across Nigeria, eliminate double taxation, use taxation to encourage private sector investment in critical industries and boost disposable incomes through targeted tax exemptions.

“A notable feature of the reforms is the proposal to reduce the corporate income tax rate from 30% to 25% over the next two years. This reduction seeks to alleviate financial pressures on businesses and foster investment.

“The bills propose a significant shift in VAT revenue distribution, allocating revenues based on the states where goods and services are consumed rather than pooling them centrally for redistribution. The Federal Inland Revenue Service (FIRS) Chairman, Zacch Adedeji, explained that this approach aligns VAT with its nature as a consumption tax.

“The reforms propose exempting individuals earning below the minimum wage from the Pay As You Earn (PAYE) tax. Similarly, small businesses with annual turnovers of N50 million or less would be exempt from paying taxes.

“The Nigeria Tax Administration Bill aims to standardize tax rules across federal, state, and local levels. This measure seeks to reduce taxpayer confusion and compliance costs, thereby enhancing transparency and efficiency in tax collection.”

While the bills seek to make crucial reforms and restructure Nigeria’s fiscal policy to boost government revenue, there has been stiff opposition from the North, notably led by Senator Ali Ndume, representing Borno South, and governor Babagana Zulum of Borno State. One critical area of concern for Northern dissenting voices against the bills is derivation and sharing formula on VAT. Governor Zulum vehemently argued that the tax reform bills will favor only a few states, pointing to Lagos and Rivers. In same vein, Lagos State governor, Babajide Sanwo-Olu, in response to Zulum, argued on the contrary, that Lagos may experience some losses, however the reforms would provide opportunities for federating states to play a more significant role in the national economy, requiring everyone to work harder to realize their full potential.

The tax reform bills could mean different things to different people depending on the context of their argument. For the academics, tax experts, economists, politicians, and regional interests, the tax reform bills all take a different shape other than the merits of its components as proposed by the Presidency. In all the uproar on the tax reform bills, the proposed VAT increment from 7.5% to 15% by 2030 has raised concerns on how this would affect rise in inflation.

A Northern youth, Ahmad Ganga (@AhmadGanga) commented on the tax reform bills on X, stating “the issues with the tax reform bills lie in the 60% derivation formula and the exponential increment of the VAT rate from 7.5% to 10%, 12%, and subsequently, 20%, whereas the per capita income is at its lowest ebb and the productivity is at an all-time low.”

The issue of VAT increment represents the fear of the ordinary Nigerians. Reality has demonstrated that whenever there is a government regulation on tax increment, the market pushes all additional cost on products and services to the end user. This automatically causes high inflation, exacerbating a cost-of-living crisis in the economy.

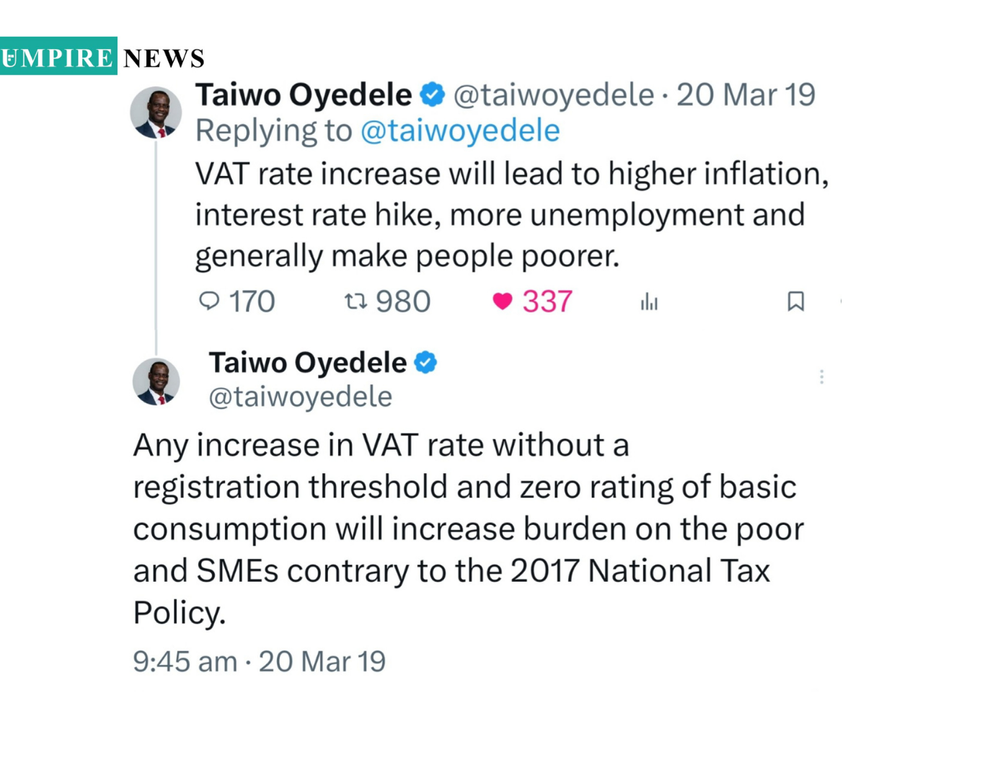

Nigerians on X have further called out what they termed “hypocrisy” of Taiwo Oyedele–the Chairman, Presidential Committee on Fiscal Policy and Tax Reform. In an X post in 2019, in reaction to VAT increment by the Buhari’s administration from 6.75 to the current 7.25%, Taiwo Oyedele (@taiwoyedele) had commented “VAT rate increase will lead to higher inflation, interest rate hike, more unemployment and generally make people poorer.” Nigerians have questioned Mr. Oyedele’s integrity and positional change, considering the recent tax reform bills, if the propositions therein would not take a worse turn if passed to law, given the current government’s similar about-turn to its agreement with organized Labor–to accept ₦70,000 minimum wage against non-increment in petrol price.

In addressing the raging debate on the proposed VAT increment by the tax reform bills and fears of possible higher inflation. The Chairman, Presidential Committee on Fiscal Policy and Tax Reform, Taiwo Oyedele, took to his X handle (@taiwoyedele) yesterday 6 December 2024, to address critical questions that had arose in the ongoing debate on the tax reform bills. Especially, the issue of proposed VAT increment.

Mr. Oyedele wrote on X, “PROPOSED VAT REFORM WILL REDUCE, NOT INCREASE INFLATION

“Some people have expressed the view that the proposed VAT rate increase as part of the Tax Reform Bills will fuel inflation and lead to more hardship for the people.

“To address this issue, let’s examine the facts and answer some key questions:

“Question 1: There are concerns that the VAT reform contained in the tax bills including the proposed increase in VAT rate will lead to inflation. Is this so?

“Answer 1: No. The VAT reform, including the proposed increase in VAT rate, is part of a package involving several measures designed to reduce, NOT increase prices and therefore will not lead to inflation.

“Question 2: But this position seems inconsistent with the views expressed by major actors in the current reforms when the previous government planned to increase the VAT rate in 2019. What has changed?

“Answer 2: The major actors argued at the time that an increase in VAT rate will lead to inflation, which would reduce the purchasing power of Nigerians and increase economic hardship in the country.

“However, unlike the 2019 VAT rate increase proposal which was not accompanied by measures to reduce costs, the current proposal is a package of reform, which is much broader than just a rate increase. The reform involves several measures to reduce production cost, reduce the incidence of VAT on most essential consumptions, and exempt more small businesses from charging VAT.

“Question 3: Can you make it make sense?

“Answer 3: Inflation occurs when there is a general increase in the prices of goods and services. An increase in VAT rate may lead to an increase in prices thereby causing inflation. However, the proposed VAT reform is not just about increase in rate, it contains several proposals to eliminate VAT or reduce rate which altogether is unlikely to cause inflation.

“Specifically, the VAT reform measures include:

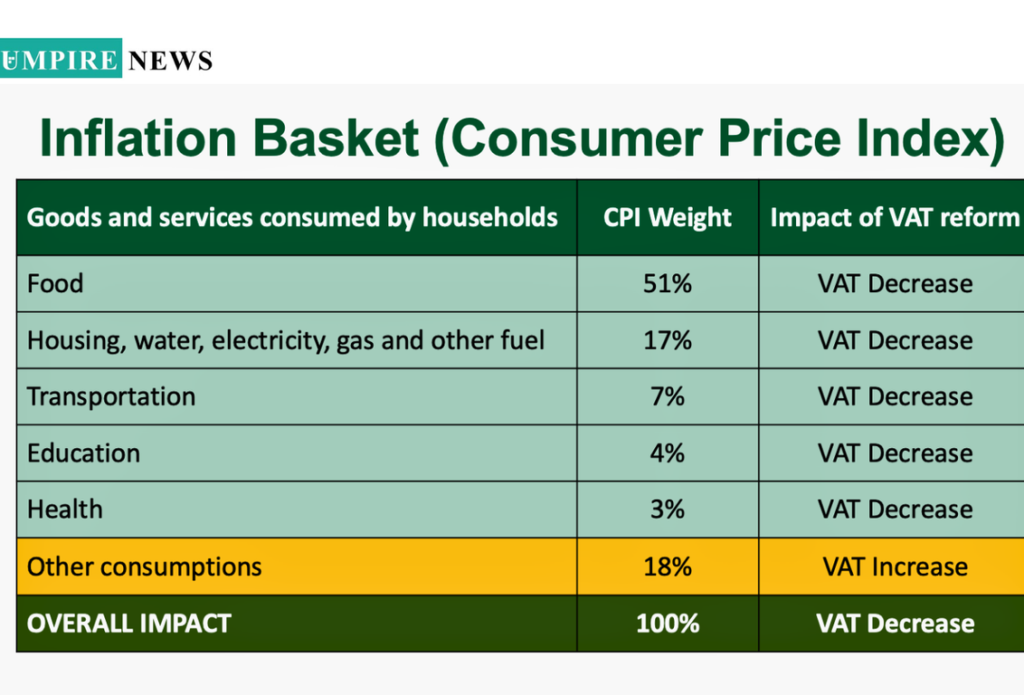

a) A reduction in the VAT rate to 0% and exemption for essential items accounting for 82% (about 4 out of 5 items) consumed by the masses including food, medical services and pharmaceutical products, tuition and other educational expenses, transportation, fuel products, and rent. (See the Consumer Price Index basket of goods and services).

“b) Businesses will be granted tax credits for VAT paid on their assets and all expenses incurred to produce VATable goods and services. This means up to 7.5% reduction in the cost of production compared to the 2019 proposal where companies were not allowed to claim tax credit for their VAT costs which they then passed on to customers by way of higher prices. This proposed measure will eliminate the VAT cost currently borne by businesses and should therefore lead to lower prices. Going forward, this measure will ensure that businesses in Nigeria no longer bear VAT cost regardless of the rate.

“c) An increase in the VAT exemption threshold for small businesses from N25m to N50m. This will remove the VAT burden on the margin of goods and services sold by such businesses who are usually patronized by the masses.

“d) An increase in VAT rate on a limited number of goods and services constituting only 18% (about 1 in 5 items) of average consumption items in the inflation basket such as beverages, entertainment, cars, etc. These items are consumed more by the middle and high income earners than the poor.

“Question 4: Okay, but won’t a business that pays a higher VAT rate for any item such as company vehicles, other assets, and raw materials, eventually pass it on to its customers by way of higher prices?

“Answer 4: No. Remember that under these proposed reforms, businesses will be allowed to claim input credit for any VAT paid for the purpose of producing their VATable goods and services, so such businesses will become VAT cost neutral. This input VAT credit will also reduce the financing cost of assets and working capital for businesses,

encourage formalization for the informal sector given that a business needs to be registered with the FIRS to claim input VAT on its assets and other costs. In addition, the reform will improve Nigeria’s competitiveness and ability to attract investment within the African region and globally.

“Question 5: Isn’t there a risk that businesses may not get the VAT credit on time or ever from the tax authority? What is the assurance that this will be effectively implemented?

“Answer 5: There is no risk that a business will be denied a credit for its valid VAT claim. The VAT system has an inbuilt mechanism whereby a business is allowed to offset its input VAT by itself against its output VAT. The permission or approval of the tax authority is not required. In the event that a company does not have sufficient output VAT to offset its input VAT, a faster refund process is contained in the tax bills to grant such refunds within 30 days either in cash or with the option to utilize it for the payment of other taxes, at the discretion of the taxpayer.

“Question 6: Alright, but why is it necessary to increase VAT rate on any item? Why not just reduce VAT and move on?

“Answer 6: The various rate reductions and VAT credits will result in significant decline in government revenue from VAT which is a major source of government funding particularly for the states and local governments who share 85% of VAT (proposed to increase to 90%). Without an increase in the rate for some non-essential items to partly offset the reduction in revenue, many of the states and local governments may face financial difficulties. The limited rate increase also ensures that the VAT regime is progressive, whereby the masses bear little or no VAT burden while high income earners progressively bear higher incidence of VAT based on their consumption patterns and preferences. This promotes fairness and equity in the system by redistributing income, a major objective of the tax reforms.

“Question 7: So, rather than generalizing that the proposed VAT rate increase will lead to inflation, we need to check the details of the reforms before drawing such conclusions.

“Answer 7: Absolutely. Unlike the previous proposal to increase VAT rate, the current VAT reform seeks to:

“• Reduce VAT to 0% and exempt basic items constituting 82% of consumptions

“• Grant input VAT credit on assets and other costs to businesses making them VAT neutral

“• Increase the VAT exemption threshold for small businesses

“Context matters. Any generalization that the reforms will increase poverty is unfounded. Rather, these reforms will actually provide relief for the masses, reduce inflation, enhance purchasing power and reduce poverty.”

Mr. Oyedele’s explanation above may be theoretically sound. However, the Nigerian market reacts abnormally to any tax increment by government. The ripple effect of such market reaction affects the entire economy. While the tax reform bills have been passed to Second Reading in the Senate and the debate is ongoing. It is necessary to take a critical look at reducing or completely removing the proposed VAT increment.

What Nigerians do not need is a potential VAT increment that could possibly exacerbate already worse living conditions and further economic asphyxiation of the masses, irrespective of what select items or sectors such increment is targeted. The Nigerian market reality would be adversely affected by a higher progressive VAT increment, notwithstanding targeted sectors and income range. Should the proposed VAT increment be a minimal static figure, it would have been different, probably with minimal effect, however, a 10%, 12% and 15% progressive VAT increment by 2030, would impact inflation across board to sectors or items not primarily targeted.

The other premise for progressive VAT increment advanced by Mr. Oyedele is that reduction of VAT rate on other basic items will affect government revenue from VAT sources for states and local governments. This argument falls flat on the basis that VAT is not the major or primary source of government revenue, but one of several. Further, if the proposed tax reforms are truly to boost productivity with more fiscal responsibility within states and local governments, as presented by proponents of the bills, then as a matter of expediency, appropriate economic policies would be adopted and implemented by states and local governments. Prudent administration of public funds would suffice. Therefore, it is reasonable that the government stops any progressive VAT increment in the tax reform bills to avert potentially higher inflation rate that could trigger far worse economic conditions for majority of the people.