The Tinubu NIN credit score reform will completely change how lenders and the government handle credit accountability in Nigeria.

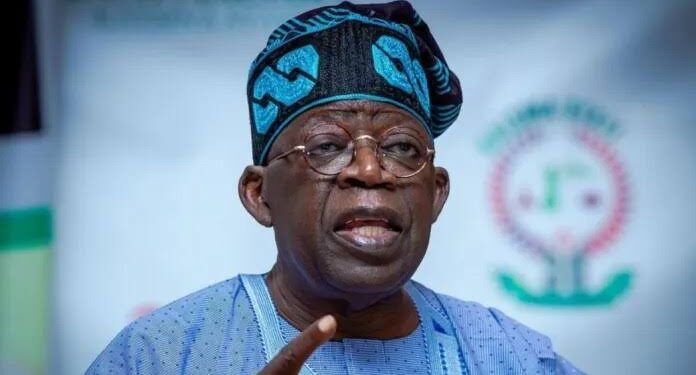

President Bola Tinubu’s government now plans to link every Nigerian’s credit records directly to their National Identification Number (NIN).

This reform aims to build a transparent credit system where borrowers face real consequences for loan defaults or bad behavior.

Uzoma Nwagba, Managing Director of the Nigerian Consumer Credit Corporation (CREDICORP), revealed the plan during a State House briefing.

He said the Tinubu NIN credit score reform will track all borrowing activities, no matter the lender or institution involved.

Whether you borrow from a bank, microfinance firm, or digital lender, your actions will now create a traceable credit trail.

“Your NIN becomes the foundation of your credit profile—miss a payment, and it’ll follow you everywhere,” Nwagba stated firmly.

He warned that defaulters could face restrictions on renewing passports, driver’s licenses, or even renting homes across major cities.

“This is not just policy—it’s a shift in behavior. There will be no hiding place,” he added without hesitation.

The Tinubu NIN credit score reform encourages financial discipline and empowers lenders to assess risk with accurate credit information.

The government wants to ensure that Nigerians who repay loans responsibly enjoy better access to future financial opportunities and support.

At the same time, it sends a message that recklessness with loans will come with long-term personal and legal consequences.

This reform aligns with the administration’s broader agenda of using digital systems to improve national accountability and economic inclusion.

As implementation begins, both borrowers and lenders must adapt to a new era of responsible credit and verified financial identity.

TODAY’S TOP STORIES:

https://umpirenews.com/tinubu-blames-gov-alia-for-benues-yelewata-massacre/

https://umpirenews.com/pastor-adefarasin-bail-viral-stun-gun-video/