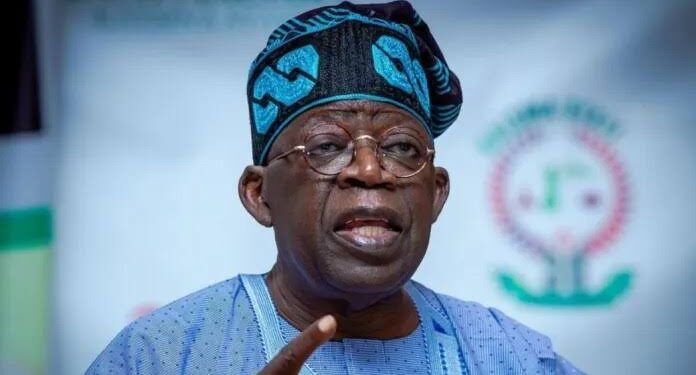

President Bola Tinubu will today sign into law four long-debated tax reform bill, according to a State House release.

The statement, issued by presidential aide Bayo Onanuga, emphasized the transformative nature of these crucial tax reform initiatives.

These tax reform bills—passed by the National Assembly—followed wide consultations with stakeholders across political and economic sectors.

The four bills include the Nigeria Tax Bill, Nigeria Tax Administration Bill, Nigeria Revenue Service Bill, and Joint Revenue Board Bill.

Together, these new laws are expected to streamline tax administration, reduce duplication, and significantly increase government revenue nationwide.

The signing ceremony will occur at the Presidential Villa, with top legislative and executive leaders scheduled to attend in person.

Officials present will include the Senate President, House Speaker, Governors Forum Chair, and top finance and legal representatives.

One of the key tax reform bill, the Nigeria Tax Bill, simplifies and consolidates the country’s previously fragmented tax statutes.

The second bill establishes a harmonized legal framework for tax operations across federal, state, and local government levels.

The third bill creates the Nigeria Revenue Service, replacing FIRS with a more accountable and performance-driven national agency.

It grants broader powers to the NRS, including collecting non-tax revenues and enforcing transparency and fiscal accountability measures.

The fourth bill introduces the Joint Revenue Board, coordinating national and subnational tax authorities under one oversight framework.

It also creates a Tax Appeal Tribunal and the Office of the Tax Ombudsman for taxpayer protection and redress.

The presidency insists these reforms will ease doing business, reduce taxpayer burdens, and attract investments both locally and internationally.

For months, these tax reform bill stirred public debate, but final amendments reportedly addressed most stakeholder concerns nationwide.

The new laws aim to replace chaos with clarity, allowing businesses and citizens to navigate Nigeria’s tax system more efficiently.