The World Bank has recommended that Nigeria’s Central Bank (CBN) halt its ad-hoc foreign exchange (FX) auctions and adopt a more systematic approach to FX market interventions. This advice, part of the World Bank’s Nigeria Development Update, seeks to stabilise the naira and encourage a flexible exchange rate policy.

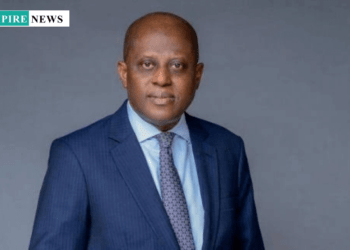

On August 26, 2024, the CBN conducted a substantial FX auction, offering $876.26 million to end users in a move away from routine Bureau De Change sales. This measure, overseen by CBN Governor Yemi Cardoso, was intended to ease demand pressure and improve dollar liquidity. However, the World Bank suggests the CBN deepen the FX market by enabling more transparent and market-reflective exchange rates. The institution also recommended building foreign reserves strategically to stabilise the naira’s valuation and support long-term economic growth.

Additionally, the World Bank raised concerns about Nigeria’s banking sector. Non-performing loans (NPLs) in Nigerian banks have risen to 5.1%, exceeding the prudential threshold of 5%. This trend, coupled with high inflation and naira depreciation, has eroded banks’ capital buffers, reducing the sector’s capital adequacy ratio from 14.2% in Q1 2023 to 11.1% in Q1 2024.

Further impacting monetary policy, the CBN’s open market operations (OMOs) mopped up N6.6 trillion in liquidity in the first eight months of 2024, a 30% increase compared to the combined amount over the past three years. The World Bank underscored that the tightened monetary policy has attracted FX inflows and helped stabilise the FX market, but cautioned on the need for a unified, transparent exchange rate policy to foster sustainable growth.

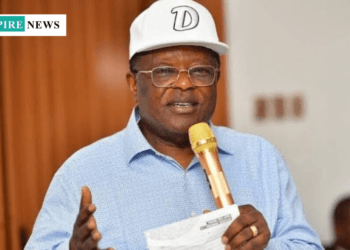

Finance Minister Wale Edun noted that while the Nigerian government values international agency input, it may not follow every recommendation, signalling a selective approach to policy adoption amidst Nigeria’s unique economic conditions.

World Bank Advises CBN to Stop Ad-Hoc FX Auctions and Promote Exchange Rate Flexibility

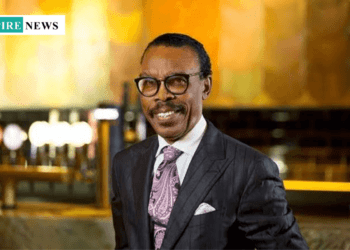

Roland Bayode

Roland Bayode is a Nigerian journalist with expertise in investigative reporting and editorial leadership. A graduate of Mass Communication, he served as Editor-in-Chief of Echo Media at Adekunle Ajasin University and was the top intern at Premium Times Center for Investigative Journalism (PTCIJ) at Owena Press, The Hope Newspaper in Akure. Roland has contributed to News Round the Clock, PTCIJ Google-YIAGA LightRay Media, Apex Sport (U.S.), and served as Associate Editor for Nigeria Grassroot News under AFYMP.

Leave a Reply Cancel reply

NATIONS NEWS

POLITICS

YOUR ECONOMY

E & P

Bournemouth’s Unbeaten Run Hits 10 Games with Stunning Win Over Newcastle

Justin Kluivert was the hero for Bournemouth, netting a sensational hat-trick as the Cherries ended Newcastle’s nine-match winning streak with...

YOUR THOUGHT & HISTORY

Who we are

Welcome to Umpire News, your go-to online newspaper dedicated to broadening perspectives and expanding the horizons of our numerous readers. Read more

Recent News

Sani Criticizes Dangote Refinery’s Unexpected Petrol Price Hike

© 2024 Copyright Umpirenews. All rights reserved