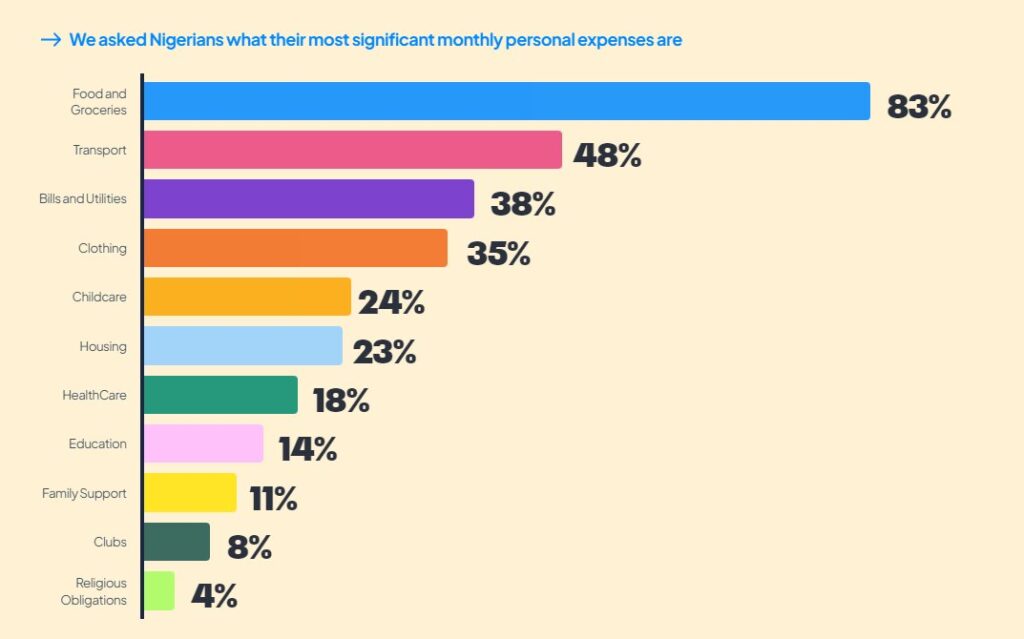

One of Nigeria’s foremost fintech, Piggyvest, a savings and investment company, carried out a survey on Nigerians’ most significant monthly personal expenses in 2024. The results indicated 83% expenditure on food and groceries. Closely followed by transportation at 48%. According to the National Bureau of Statistics (NBS) Consumer Price Index (CPI) as of April 2024, inflation stood at 33.69%.

The leading component of CPI, food and non-alcoholic beverages is 17.45% YoY. The current inflation rate is higher than the 21.82% witnessed in 2023, just a year ago. This could mean only one thing; majority of Nigerians barely afford food, a basic human need.

The federal government in July announced a 150-day duty-free waiver on food imports, to facilitate importation of wheat, maize, and husked brown rice, as part of effort to address increasing food inflation. The Nigerian Customs Service consequently announced details on implementation of this policy, effective from July 15 to December 31, 2024.

However, one month to the end of this duty-free food import window, the policy is yet to be implemented. As inflation bites harder and food prices skyrocket across the country, Nigerians are left with unfulfilled promises by the federal government.

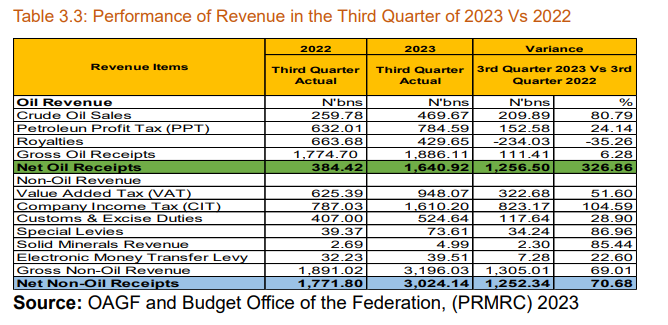

It is a fact that the major sources of government revenue include oil royalties, petroleum profit tax, company income tax (CIT), value added tax (VAT), and customs and excise duties. Although customs duties are a significant revenue generation source for the federal government, it is equally a key cause of inflation.

The remote and immediate causes of food inflation include but are not limited to insecurity preventing farmers from farming for more output; price of fuel and cost of logistics; multiple road taxes on ago-produce; agricultural value chain; and customs duties.

In June 2023, Segun Ajayi-Kadir, DG Manufacturers Association of Nigeria, stated that “the cost of importing a 40-foot container from Singapore to Apapa is virtually same as taking it from Apapa to Agbara 27km away and it will take you weeks to clear.” In March 2024, The Nigeria Customs Service (NCS) announced it generated N498.07 billion in revenue. This amounted to an average revenue of approximately N669.45 million per hour and an average of N16.07 billion daily across its commands nationwide.

The irony is, while the Nigerian Customs Service celebrates increased revenue generation from customs and excise duties, the brunt is borne by the Nigerian consumers who suffer higher food prices. Grimmer is, having to pay high prices in the market for less quantity of food with a devalued Naira that has wiped off half of Nigerians’ purchasing power since May 2023.

On Tuesday, 13 August 2024, the Nigeria Customs Service (NCS) said the federal government will be forfeiting N188.37 billion in revenue in suspending import duties on food commodities. This argument falls flat in the scale of patriotism or altruism for a viable economy, since the Nigerian Senate spent N57bn on SUVs for lawmakers in the last quarter of 2023.

Another argument for sustaining high customs and excise duties is that more money is allocated to the States and the federal government’s adoption of rice sharing palliative to States. The reality across States and among majority of the citizenry remains glaring that allocating more money to States and sharing trucks of rice does not correlate to positive impact neither does it reduce food inflation.

A Nigerian US-based financial analyst, Kalu Aja, argued vehemently, stating “I am asking the FGN to adopt a fixed $1 to N200 for food imports for three months to compliment the zero tariff on food import policy. The one-time revenue ‘loss’ will be maximum N500b (Customs and Excise Duties), far CHEAPER than what is being spent on sharing cash to Governors to buy rice and other palliatives.

This can be done tomorrow, no NASS, no new spending, it will crash food prices immediately.” He wrote on his X handle–a popular social media app. Aja continued, “Food is 51% of CPI, crashing food price crashes inflation. Food is 57% of average household budget, if food prices fall, it’s an INCREASE in the minimum wage especially for lower income folks.”

The premise of Aja’s argument above is rooted in the basic economics law of demand and supply. In this case, an increase in supply will crash food prices. What then is the government’s role in this? Government’s key role in reducing food inflation is facilitating increasing supply of food to Nigerian markets and households nationwide. If the government sets a target on how many tonnes of varieties of foods and time frame it will achieve such supply of food, inflation will drastically reduce, if properly implemented.

Although, implementing a zero-duty on food import is a short-term solution, it is a viable alternative to cushion the effects of high food inflation. The zero-duty policy on food import is yet to be implemented till date.

Lucky Amiwero, the President of the National Council of Managing Directors of Licensed Customs Agents, stated “we don’t know what is going on” as he expressed his frustration at the government’s complete lack commitment to implementing the zero-duty policy. The federal government should extend the zero-duty policy till 31 December 2025, implement fully and unambiguously, to address the critical issue of high food inflation in the country.

On the long term, government should tackle insecurity, to enable farmers to freely farm needed food produce; address issues of fuel supply, the NNPC and Nigeria’s four refineries; and multiple road taxes on agro-produce. The Central Bank of Nigeria and the Ministry of Finance need to stabilize the Naira from further depreciation. This is necessary for food imports and productivity in the economy.